Worth Create Belongings isnt a great cookie-cutter homebuilder. Indeed, i bust your tail to be additional. I focus on building customized property on the land in NC , dealing with you against inception through closure. And we can also be hook your towards top mortgage lenders in the the industry, as well!

Selecting the right bank for your condition are a life threatening region of one’s homebuilding techniques. We’ll aid you as a result of every step within this techniques, playing with our very own the means to access the framework loan experts so you can get the very best funding plan you are able to to help you make your dream house.

How to Qualify for a home loan during the Vermont

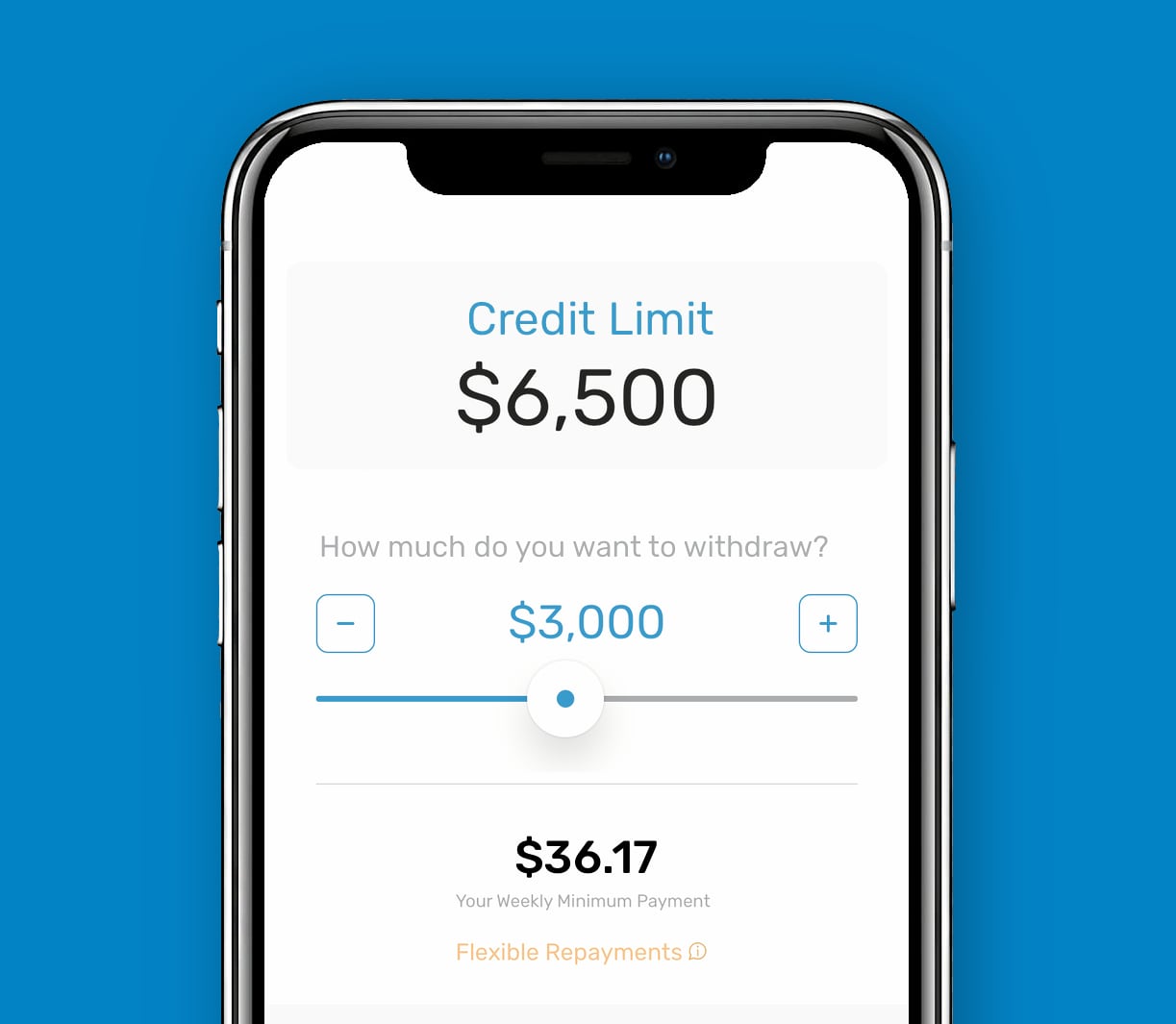

New york has the benefit of some programs that give information, financial help, or any other information. An element of the things you need accomplish is: step one.) know very well what you can afford, and you can 2.) understand what type of finance you can qualify for.

With respect to understanding how much family you really can afford, understand that also buying the home, you need to have money set aside to have restoration & fixes, resources, and you may emergencies. Including, loan providers like a financial obligation-to-earnings ratio less than 42%, so you should definitely have as little financial obligation that one can.

There are a variety off a way to finance a home inside the NC, also FHA loans, antique money, and offers. (The newest Vermont Houses Funds Agency features aided tens of thousands of Northern Carolinians into the purchasing home that have many capital solutions you to create to invest in a different sort of family reasonable!)

Before you are doing whatever else, it is important to understand where your borrowing from the bank stands. Have no idea exacltly what the credit personal loans in Richmond UT rating was? Look at the credit rating at no cost having Experian. If your credit history is actually 620 or more, you have a spin at providing approved to own a traditional financing.

FHA financing are great for anyone and you may parents which have lower to modest income and less-than-finest credit ratings. He could be backed by new Government Houses Government (FHA), and may also help you qualify for a property should you maybe not meet most other standards.

Conventional finance (fixed-price, adjustable-speed, conforming, non-conforming) is loans which aren’t backed by a federal government agency. Antique mortgages always need certainly to meet down-payment and you may earnings conditions place of the Fannie mae and you can Freddie Mac computer, and you can comply with loan restrictions lay by Government Property Funds Management (FHFA).

Having assessment: The latest down-payment towards an FHA mortgage try much less than simply a conventional loan, usually no more than step three.5 %. While you are a conventional mortgage will need a score of 620 or significantly more than, that have an FHA mortgage, you just need a score of at least 580 to be considered. If your rating try between five hundred and you can 579, you may still be capable of geting an FHA mortgage if the you put 10% down.

Government-backed loans (FHA, Virtual assistant, USDA) are useful without having great credit otherwise big advance payment. But when you enjoys a good credit score otherwise is lay additional money off, a normal mortgage is probably a better choice. (The greater number of money you put down, the lower your mortgage payment would-be!) Examine the various selection and their benefits & disadvantages to discover the correct mortgage to you.

Is actually Resource a different Framework Home Different from a Used Family?

In manners, financing a special construction home is the same as taking a mortgage to acquire a selling house. However, there are a few variations. Such as for example, designers of the latest structure property (such as for instance Worth Generate Home!) may offer financing bundles, often in person through our very own mortgage subsidiary or a reliable regional financial .

Concurrently, you will find novel financing you to definitely apply to the new home however so you can resales, eg link loans and you may the new-construction financing. These are accustomed finance the acquisition and you may structure out-of a new house before the sales of the newest family.

When choosing a lender, you want a person who knows and will direct you through the brand new design processes, make you loan possibilities, and help you choose one that suits debt need. Like, capable make it easier to figure out if you desire a property loan.

Build funds financing this building of the property. When you are strengthening a totally custom-built home , needed a homes financing to pay for price of the newest information and you will work to build our home one which just reside it. He could be quick-identity funds, as well as can be found in more differences, particularly Design-Simply otherwise Design-to-Long lasting. An experienced bank will be able to make it easier to decide how exactly to afford a property during the NC.

Tips Fund A home inside NC

With respect to funding a house inside NC, more educated and you will prepared youre, the faster and easier it would be. Gather the records beforehand, understand your credit rating, clean through to various financial support solutions, and choose suitable financial for the condition. Telephone call (919) 300-4923 or contact us to learn more about the financing options that have Value Make Property.