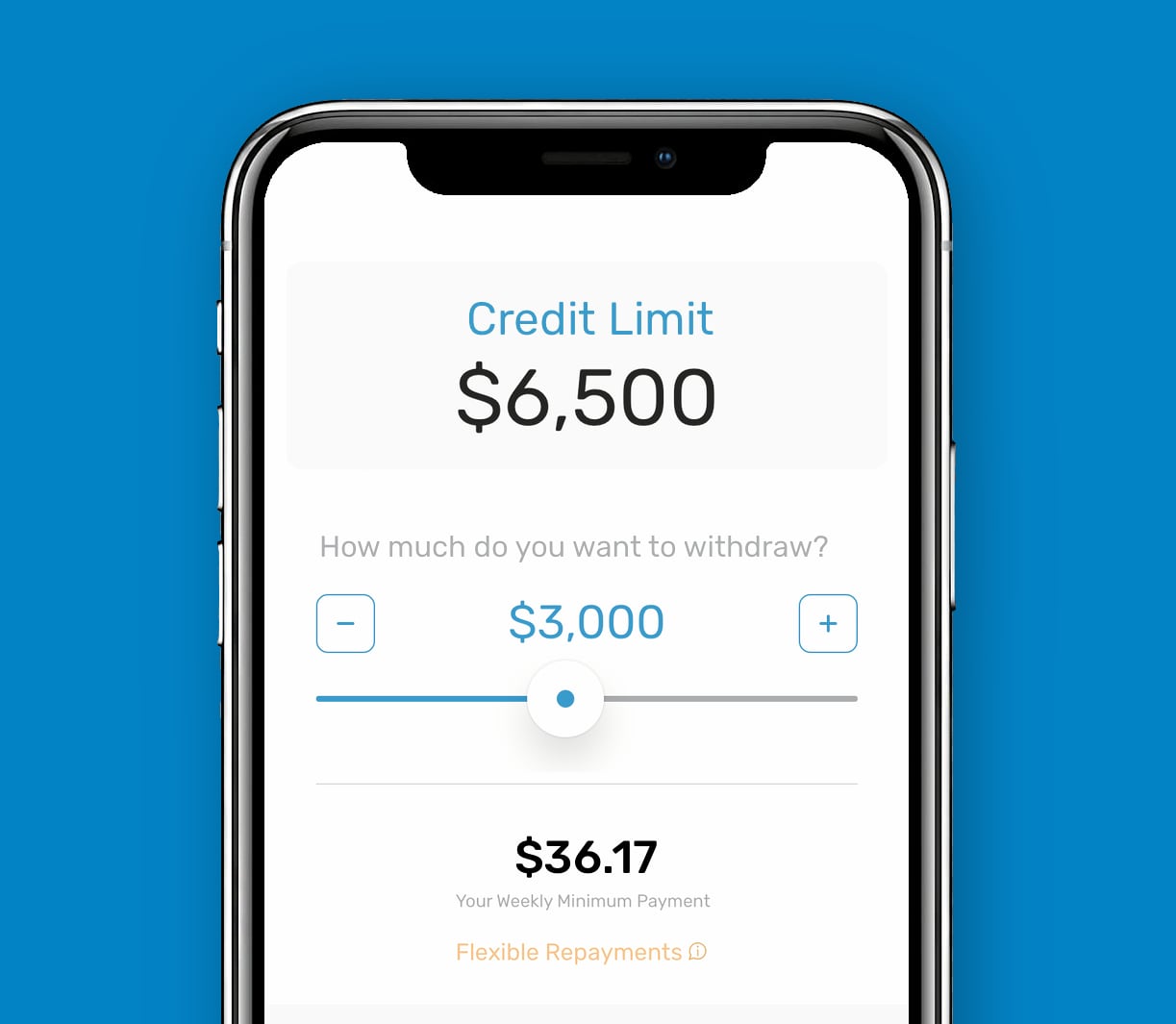

Unlock the door to your house fundamentally, with in initial deposit only 2% of the property worth. Observe reasonable-put mortgage brokers work.

- Lower Deposit Home loans

Low-deposit mortgage brokers are made to get you into the the brand new family prior to when you thought by permitting that buy an effective home with a deposit as little as dos% of the home really worth. The efficacy of homeownership will then be on your hand.

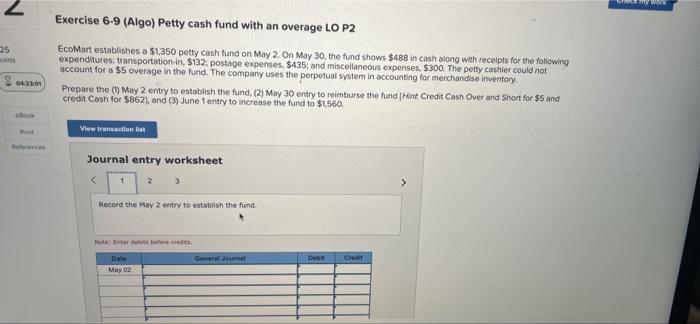

Just how do Low-Deposit Financing Performs?

Due to the fact consumers render less put with this kind of financing, they have increased Mortgage-To-Really worth Proportion (LVR). It indicates lenders may need these to shell out Loan providers Home loan Insurance rates (LMI). New LMI protects the lender if for example the debtor defaults to the the mortgage.

Just after you’re accepted having a low-deposit financial, you can enjoy apparently an identical rates of interest because the a person who features good 20% deposit. Continue reading