Prominent levels have totally free Atm usage of all of the ATMs, along with non-Webster ATMs. During the this type of ATMs, Webster pays people proprietor fees. Other checking levels possess free supply only to Webster ATMs, at which discover from the three hundred, pass on in their says out-of organization.

Where Should i Discover Webster Lender?

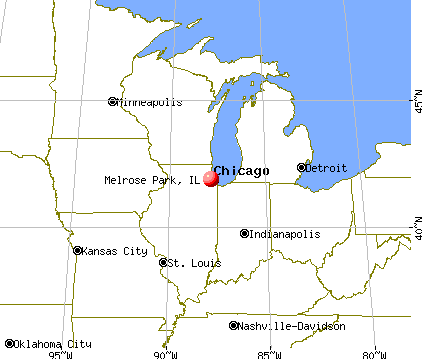

Webster really does organization when you look at the four says: Connecticut, Massachusetts, Rhode Isle and you may Nyc. Most of the the places have been in Connecticut. Its Ny and you will Massachusetts urban centers are limited to small section. They do not have people towns and cities inside the Nyc or Boston.

Webster also provides free online and you will mobile financial with levels. Has were mobile have a look at deposit, electronic costs commission, transfers anywhere between account and you may membership comments. You could glance at current deals on the debit and you can credit cards.

You want to remember that Webster’s application are defectively ranked to the Fruit application shop. It has merely step 1.seven celebrities out of four, with 76 analysis.

How can i Access My Money?

If you prefer dollars, you could potentially withdraw currency for free at the a beneficial Webster Atm. The lending company has approximately 3 hundred ATMs, many for the Connecticut. Webster charge a great $2.50 fee for some spends on non-Webster ATMs, and additionally people Atm manager charges, although some levels is excused. It’s also possible to glance at account balance and you can transfer currency having fun with Webster’s cellular software otherwise web site.

How can i Help save More income With Webster Bank?

The best possibility to improve savings that have Webster Lender appear because of the higher cost the bank offers to those with a top otherwise WebsterOne Family savings. For individuals who discover one particular membership, you get accessibility Computer game cost as much as 0.50% to own a two-year Cd.

The individuals account has fairly higher lowest balance, although not. Such as for example, to eliminate paying a good $ ($ with head deposit) monthly services commission with the a good WebsterOne Relationship account, you really need to care for an equilibrium of at least $cuatro,000 round the checking, coupons, and cash business membership. Which means you’d you would like at the very least $5,000 to open up a beneficial Computer game to your large rates (minimal equilibrium to own a beneficial Video game are $step 1,000).

What is the Procedure having Opening a merchant account Having Webster Bank?

You could potentially unlock a benefit or checking account from the Webster Financial web site. To do so you’ll need your Social Protection matter, license and you will employment recommendations. With this advice available, the process is very brief, long-lasting below 20 minutes or so. Make sure you read the minimal account balances to quit solution charge (revealed significantly more than), being open your account with plenty of money.

What is the Hook?

Webster possess an extremely local impact, limited by Connecticut and you can regional servings of some claims. Lawrence installment loans Being able to access your money away from one to impact might be difficulty if you don’t provides a premier Checking account (Webster talks about Automatic teller machine fees of these levels).

While doing so, Webster’s costs for the offers and money business membership are not such as for instance higher. Such accounts generally speaking earn just a few fractions from a per cent, somewhat less than national averages. Higher cost are kepted to possess consumers just who discover certainly one of Webster’s high-prevent examining levels, Premier and you may WebsterOne.

Conclusion

If you live and you will are employed in Connecticut, Webster Bank has the benefit of a fair local-option for your private banking demands. It has a complete array of financial features. Interest levels are not such on top of most accounts, regardless if highest rates are available to consumers whom open particular elite group checking profile.

Unfortuitously, we’re already unable to pick checking account that fit their criteria. Delight replace your search requirements and attempt once again.

Regrettably, our company is already struggling to get a hold of checking account that fit the conditions. Please change your look criteria and check out once more.

Webster Value membership offer a flat rate regarding 0.01% APY toward every deposits, but the other sorts of deals account possess an excellent tiered price program, which have one to account having large costs having large deposits. Pricing throughout these accounts commonly including highest whenever you are perhaps not transferring half dozen numbers, nonetheless they would overcome larger national banks.

The main reason Premier and you may WebsterOne profile want large balance are that they will let you access large interest rates towards the Webster Cds and savings levels, as well as specific deals toward funds such house collateral funds and you may mortgages.