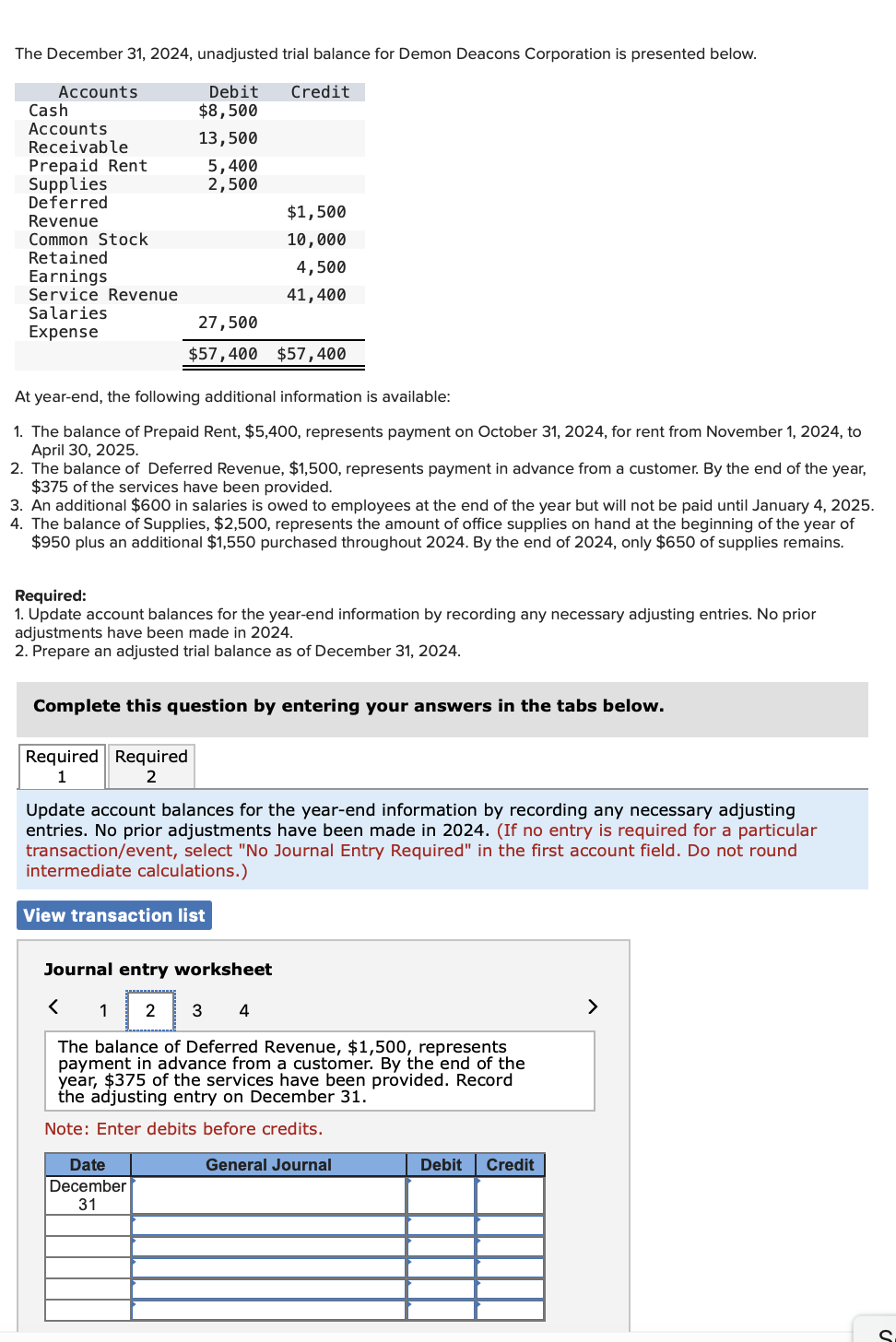

How i made it happen: to make my personal very first-domestic fantasy be realized

It’s the matter hanging along the minds of earliest home consumers. Therefore the answer can vary significantly based on how rapidly we would like to score onto the possessions ladder and you can hence bank you are going with.

Ultimately, you’re going to need at least a 5% deposit. So start to work out what you’re aiming to buy and how much it’ll cost, and then you can start protecting with a definite objective planned. Let’s take a look at your options when it comes to the deposit on a home loan, so you can lock in a savings goal with more confidence.

Reading particular financial language

In advance of we diving towards the outline in the dumps, you could link the head as much as some typically common terms and conditions employed by lenders. These materials can dictate how much cash you really need to save your self.

Mortgage in order to value proportion (LVR)

This can be a share, calculated because of the isolating extent your borrow on the financial institution-examined worth of the house or property. For example, for many who obtain $eight hundred,000 to order a home valued from the $five hundred,000, new LVR of loan try 80%.

Lenders financial insurance policies (LMI)

This will be an insurance you often have to spend in the event the your own LVR is higher than 80%. It’s insurance cover on the bank to safeguard them but if you standard on the home loan while the assets deals isn’t high enough to cover what you owe.

Relatives be certain that

This is where some one on the loved ones (a beneficial guarantor) spends the fresh new guarantee in their assets given that coverage for your mortgage, which means that they commit to be responsible for the loan if the your standard otherwise are unable to spend.

What is into the 20% code?

The quantity you’ll be able to pay attention to very whenever talking dumps is 20%. There is certainly this unspoken code that you should save yourself no less than 20% of the financial-analyzed worth of the home to obtain a home loan. But … that is merely real or even need to otherwise cannot pay LMI otherwise explore children be sure.

Having a more impressive deposit off 20% beneath your buckle, you don’t have to borrow as much currency. Meaning that you’ll spend shorter in the attract over the longevity of the loan. While don’t have to care about that have LMI.

Very, rescuing upwards good 20% put might be worth it. However, if it feels far too unlikely, you really have other choices.

Really does 20% getting out-of-reach?

Nowadays, really lenders deal with dumps off only 5% (in other words, the fresh new LVR try 95%). But, as stated above, a low put includes a big caveat. LMI.

LMI it may be a giant additional cost in addition home-to acquire process. But in urban areas, particularly Questionnaire, where assets costs are high, next somebody are able to see LMI since an opportunity to log on to board the https://paydayloansconnecticut.com/south-windham/ home ladder much faster. In place of investing decades life frugally and rescuing all of the cent to the a big deposit, they conserve a smaller put and use LMI to purchase so they really you should never miss out on the ability to pick.

Your most other choice is so you’re able to join the help of a family group affiliate. With regards to support, you could potentially only need a good 5% deposit. Remember, it’s a large query. So speak it courtesy very carefully, provide the ones you love affiliate the chance to securely check out the implications on their own as well as their property, and make certain you are all of the clear on everyone’s commitments for many who go down it roadway.

It is very crucial that you keep in mind that borrowing 95% of the house really worth can get suggest your payments are quite large. Then you will must make sure that you are able to purchase this type of costs constant.

Crunching new wide variety

Once you have felt like whether or not to choose the newest 20% mark or otherwise not, you can start crunching the brand new numbers towards just how much possible need certainly to save your self. Working out your own credit energy assists at this point.

Why don’t we explore an effective $650,000 household such as to exhibit just how much put you may require (to own simplicity’s sake, we are going to skip will set you back such stamp responsibility for now but it is worthy of noting that those costs should be paid off ahead of the deposit):

If you only want to conserve a beneficial 5% deposit, then it you’ll feel like this: $650,000 x 5 / 100 = $thirty two,five-hundred (this new LMI might be or as part of the loan)

Which is a pretty massive difference, actually it? Using second route might get you on owning a home before just factor in the other cost of LMI (and this can be good) therefore the fact that you’re going to have to obtain a many more currency ($618,five hundred instead of $520,000), so that your repayments could be large and you’ll spend alot more when you look at the attention over the title of your own loan.

The bigger the better?

The jury’s out on this package. If you find yourself a much bigger deposit of course has its own benefits, for almost all the ability to begin household-browse prior to is more very important.