Its a great nonconforming home loan. Maximum jumbo mortgage restrict may differ dependent on the place you real time, however, usually, he is money one exceed $647,two hundred.

Mortgages one to meet or exceed this new compliant loan limitation are known as jumbo money. These types of funds don’t meet the requirements to get ordered by the Fannie mae otherwise Freddie Mac and are also financed individually by the loan providers to consumers.

As the jumbo loan limit is an outrageously lot of money, jumbo mortgage loans possess stricter guidelines and require much more documentation than just compliant loans.

In many cases, individuals with the type of mortgage brokers has down fico scores and make big down payments to track down approval getting financing since the lender tend to happen greater risk should your debtor non-payments with the its payments and you will worth of decline.

What’s the difference in a normal mortgage and you will a good jumbo financing?

Area of the difference between a traditional financial and you can an excellent jumbo loan is different limits how much money you can use.

A normal loan was insured from the Fannie mae otherwise Freddie Mac and ordered of the people with the second home loan business.

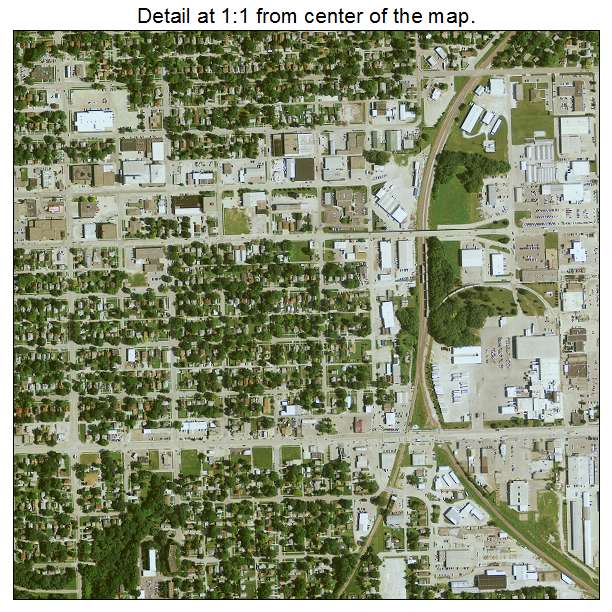

Jumbo Mortgage Limit U . s .

The fresh new high-stop limits depend on the typical price of a property towards you, and you may pay attention to places that a residential property costs are rising quickly.

The new compliant financing maximum can be reasonable once the $647,two hundred otherwise as high as $970,800, according to median home values towards you. Therefore, we provide your jumbo financing become more than you to count.

Exactly who Demands good Jumbo Real estate loan?

There’s absolutely no restrict jumbo financing restriction how much your is also borrow with this home loan device. That is to the bank to determine centered on your position and you can total financial fitness.

High-net-worth anybody

Jumbo fund commonly for everybody. This is because jumbo finance was mortgages that have loan numbers more than the fresh new compliant limitations place because of the regulators-backed organizations (GSEs) such as Fannie mae and you can Freddie Mac. Because of that, he’s more strict requirements.

An average number a borrower can get to blow into the a great jumbo mortgage is approximately 0.25% so you’re able to 0.5% higher than whatever they perform pay on the a conforming loan, this is almost certainly not worth it with regards to the size of financial and you may period of time you plan to invest of your house.

Exactly what are your downpayment alternatives?

If you don’t have 20% to put down on your home purchase price, your bank will most likely wanted personal financial insurance coverage (PMI).

PMI covers lenders for those who default on the money, but it’s along with an extra expense to own individuals who are in need of let picking out income installment loans in Vermont with bad credit their down-payment finance.

When you can set 20% off or even more, PMI will never be called for, and you will save money ultimately.

Interest levels

Jumbo mortgage rates are more than antique finance-generally up to 0.5% much more. The better the new jumbo loan restriction, the better the attention.

These types of funds has less danger of offered into supplementary markets, and you may loan providers make up for that it chance because of the billing a high attention price.

Being qualified to your mortgage

You’ll need to meet particular obligations-to-earnings ratio and you may borrowing from the bank criteria so you can be eligible for a great jumbo loan, even after a hefty downpayment and you may a good money.

Homebuyers’ for the pricey areas

Thought an excellent jumbo loan if you are searching to obtain good financing to purchase a costly assets. You’ll likely have to satisfy some standards to help you qualify, in addition to with a leading credit rating and you will a massive downpayment.

Jumbo fund are perfect for people who are to acquire house in costly areas otherwise borrowing currency to shop for deluxe trips homes otherwise funding properties.