Have a tendency to Bringing Pre-Approved Damage Your Credit?

While thinking about to acquire a home, you really know that their borrowing performs a crucial role inside the bringing approved having a mortgage. The higher your credit rating, the higher your own words are, therefore making certain you’ve got the most useful get you’ll is very important.

But not, you’ve almost certainly along with read you to definitely bringing pre-accepted is damage your credit score. Additionally you remember that you ought to get pre-accepted (unless you’re expenses bucks) because that will say to you exactly what home you could potentially search for.

Information Your credit rating

Your credit rating is made up of four different facets, and you can understanding them allows you to know what to complete next.

- Payment History thirty five%

- Amounts Owed 29%

- Duration of Credit history 15%

- Borrowing from the bank Combine ten%

- This new Borrowing 10%

Such four points is actually the credit reporting agencies dictate your FICO score, and as you can observe exactly how much you borrow and exactly how well you repay your financial situation certainly are the one or two most important categories.

The course that works together with home loan pre-approvals try your Borrowing Merge. Credit Merge try 10% out of how your credit rating are factored. Whenever a lender otherwise bank brings the borrowing from the bank this will be identified while the a card inquiry. Having so many borrowing from the bank concerns in a short period of your time normally adversely apply to your credit score.

Hard Questions

Hard credit questions is inquiries that show up on their credit report, and these normally exist once you make an application for a loan otherwise bank card.

- Wanting a vehicle and you can Obtaining Investment

- Making an application for a new Credit card

- Asking for Credit line Develops on the Mastercard

- Home loan Pre-Recognition

Flaccid Questions

Flaccid concerns was issues created in your credit, nonetheless they do not show up on your credit history, which do not apply at their score.

Usually Borrowing Inquiries Apply to Your credit score?

Brand new effect regarding making an application for borrowing from the bank differ away from individual person considering her credit records. Generally speaking, borrowing from the bank inquiries keeps a tiny impact on the Credit scores. For most people, you to most borrowing from the bank inquiry takes less than four factors away from the Credit ratings.

In order you will find it’s certainly likely that borrowing from the bank concerns is also reduce your rating, the result he’s got tends to be tiny rather than other variables. Together with, the rules to have speed looking are very different compared to those to possess implementing for brand new personal lines of credit.

Shopping for brand new borrowing normally equate having greater risk, but most Fico scores are not affected by numerous questions off vehicle, mortgage, otherwise education loan lenders in this a short period of energy. Typically, speaking of managed while the just one inquiry and will have little effect on your credit scores.

How long Have a tendency to Questions Remain on Your credit report?

Hard issues will appear on your own credit history for a few ages regarding date that the borrowing is taken. Yet not, the credit bureaus only grounds all of them into the credit history to have one year on the time your credit history try removed.

How come home financing Pre-Acceptance Apply to Your credit score?

So just how does home financing pre-recognition apply to your credit rating, the solution is really absolutely nothing. Getting pre-accepted wont harm your credit score. You might get a hold of at most an excellent 5 points drop on first lender whom draws your own credit, but zero visible impact immediately following.

Another including is the fact after you run a large financial company, such as for instance Bayou Mortgage, we can eliminate their borrowing from the bank onetime and you will shop numerous loan providers for you in about 5 minutes.

Including, smooth credit brings are receiving well-known in the home loan business, particularly as a way of going good pre-acceptance. If you utilize one of several larger on the internet loan providers, chances are they are just gonna create a delicate borrowing pull until you wade significantly less than price, however, this can be problematic because the we’ll mention lower than.

What is a home loan Pre-Approval?

A home loan Pre-Acceptance is actually a procedure that homebuyers online payday loan Oklahoma read while they are ready to begin searching for a home. Attain an excellent pre-acceptance, you really need to complete home financing application and provide supporting documentation.

Measures of your own Pre-Acceptance Process:

Providing a whole home loan app making use of the needed documents is the only method to features a real pre-recognition. Even though many on line loan providers are trying to do soft borrowing inspections and you may carrying out small financial apps, these are maybe not genuine pre-approvals.

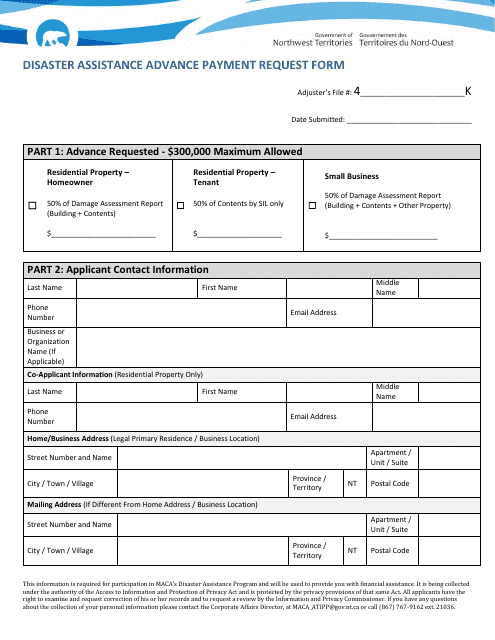

For folks who have not provided authorized a tri-matched credit history, render data one to help your income and property you are inquiring having a tragedy.

Why you ought to Score Pre-Recognized

Taking pre-approved is very important since you can’t with full confidence select residential property instead you to definitely. If you don’t have a beneficial pre-approval letter, of many real estate agents won’t guide you property. Even though they actually do direct you homes, you have got no genuine tip if you are accepted so you can choose the household.

A pre-acceptance does away with doubt and stress that is included with to get good family. Once you work on a reputable loan manager, a good pre-recognition assists you to shop with similar rely on as the a finances customer.

Bringing pre-accepted offers satisfaction, and then make your house purchasing feel a lot easier. Working with a lender and you can starting the hard works initial have a tendency to be sure to understand what can be expected initial, and can beat expensive errors afterwards.