When trying to get financing, its essential to appreciate this it is right for your. Agents can recommend various financing things considering your position, eg paying down the loan rapidly, down monthly premiums, otherwise reduced attract along the loan’s lives. However, only you could make the past decision on which mortgage so you can apply for, very ask loads of concerns while making an educated selection.

Bringing a home loan is a huge economic choice and you can lookin to have home financing can be daunting, but a specialist can guide you through the procedure. Use the knowledge to your advantage, ask hard mortgage and you can a residential property concerns, and make sure you are getting best financing to meet your needs.

Also, it is important to work with a trusted realtor that will guide you through the household-to find techniques and make certain you create an informed investment. This is how Hills Direct will come in. With the experienced representatives plus in-depth experience in nearby assets house and you may support the finest you can easily contract on your financial.

Consider contact Hills Lead today and take the original action into a lifetime of pleasure on your new home?

Please inquire about clarification or higher details about the brand new loan’s benefits, costs, and dangers

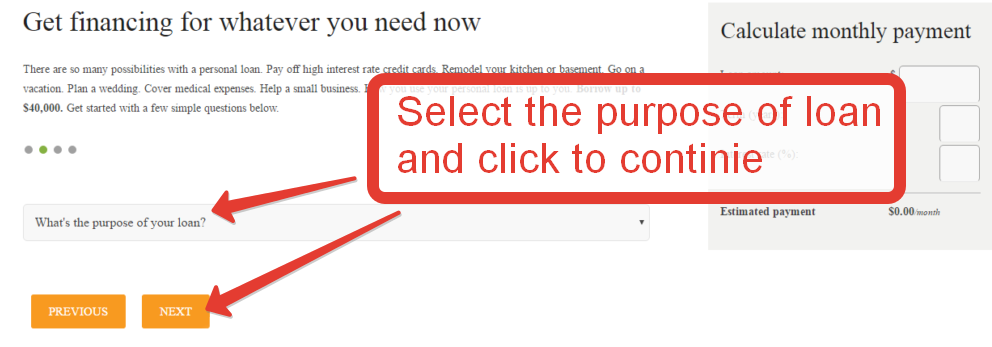

- Submit a software

- The lender operates their credit

- Select and supply the loan administrator which have duplicates of one’s W2s, tax returns, current financial comments, etcetera.

- Speak about your loan possibilities along with your mortgage administrator, and now have the outcome on paper (preapproval letter, payment per month description, closing costs guess, etc.)

dos. What will my personal month-to-month property commission feel at this price? Really does that are included with possessions taxes, insurance policies, HOA charges, and/or Mello Roos taxes (what is the dysfunction)?

step 3. Simply how much must i be prepared to shell out in total closure prices for that it deal? Perform those people number change significantly easily intimate very early compared to. later inside confirmed month and/or if We close now versus. two months out of today?

4. How can my personal alternatives change if i set extra money down otherwise less of your budget off? Really does my interest transform? Just how do my personal monthly premiums alter?

5. I really don’t want to spend the maximum, so what price do i need to stand not as much as so you can keep my monthly houses percentage below $____/month?

6. Whenever ought i Lock my personal interest along with you, as well as how Far really does your organization fees for my situation to acquire it loan?

7. Was my loan a beneficial slam dunk, or have there been specific prospective hurdles/barriers you imagine using my financing circumstance? Just what you will reduce my personal recognition as i has actually property around bargain? Exactly what can I getting working on otherwise get yourself ready for now to get this go better?

The lender will be gather information about your needs supply an effective financing that meets your situation

8. Any kind of specialization apps that we you’ll qualify for? Do you know the positives and negatives of going a thirty-12 months fixed price mortgage against good ten/step one, 7/step one, 5/step 1 Case, etc.?

9. Would it be Okay easily located element of my personal down payment money from a close relative otherwise friend (as well as how really does that actually work)?

ten. Is this a 30-year repaired rates loan (versus. an effective 15 season fixed, Case, etcetera.)? Is there an excellent pre-commission punishment if i repay the borrowed funds early?

eleven. Could you excite bring myself malfunctions off my personal overall monthly property percentage And you will my personal estimated settlement costs for many improvement situations (if i pick at this rates with this specific much down, payday loan versus. another type of speed with an alternative count off, an such like.)?