Because there is zero Va family collateral financing, armed forces borrowers features options for opening household security – for instance the Va bucks-away refinance program.

Otherwise, you can utilize a non-Virtual assistant household equity loan so you can faucet the home guarantee you’ve founded having a Va mortgage.

Accessing house collateral as the a good Virtual assistant debtor

For many years, the Institution from Experts Items keeps assisted effective-obligation provider players, pros, and enduring spouses to become residents. One of the main benefits associated with homeownership is the accrued house value – also known as family guarantee. That security might be leveraged various other aspects of the new homeowner’s existence.

Virtual assistant home owners have the same alternatives for being able to access home security because the non-military people. They also have the option of a beneficial Virtual assistant dollars-out re-finance, that’s secured from the Virtual assistant.

To own homeowners trying to accessibility their house guarantee that have a second home loan, to end affecting its most recent home loan, you will find non-Virtual assistant mortgage facts offered.

Virtual assistant house collateral options

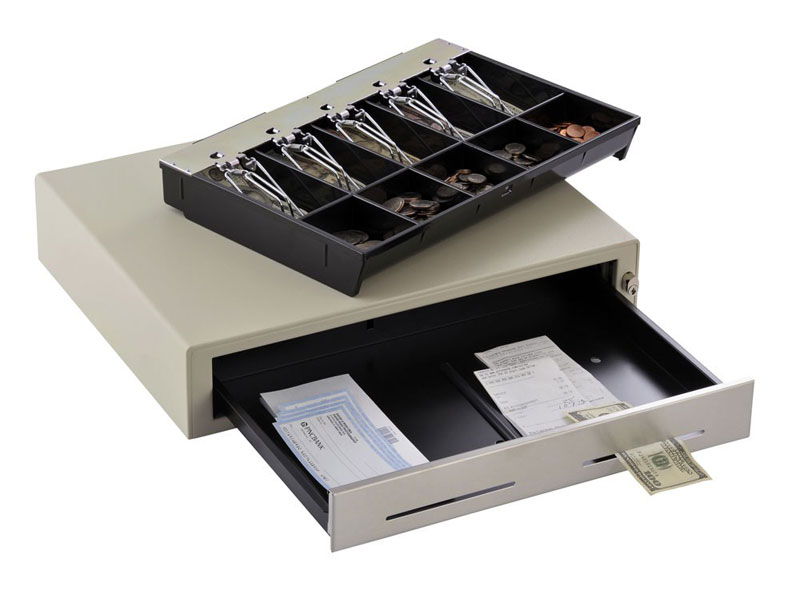

- Family security mortgage (HEL): Such finance is actually settled during the a single-day lump sum payment and you can normally function a predetermined speed. Consumers can make month-to-month costs, employing number 1 home loan repayments. These types of fund are not given by the Va but may getting used in combination with a preexisting Virtual assistant mortgage.

- Household security personal line of credit (HELOC): A different second financial that provides revolving borrowing from the bank to the entire amount borrowed. Once the first draw months finishes and the cost several months initiate, you could potentially don’t simply take cash-out and certainly will only build repayments towards the loan count. These fund are not supplied by the latest Va both but can be taken having a preexisting Va mortgage.

- Va dollars-aside re-finance: Although this is officially a home mortgage refinance loan, rather than property collateral mortgage, this new Va bucks-out refinance try a separate home loan unit accessible to Virtual assistant consumers who want to access house security whilst still being take advantage of the fresh new Virtual assistant financing program’s numerous masters. So it loan do replace the existing mortgage with a new mortgage.

What is a home guarantee financing?

House equity ‘s the amount whereby your home value is higher than the remainder harmony of home loan price – generally, brand new region you have already paid off and you may individual downright. This means that in case your residence is well worth $2 hundred,000 and also you owe $100,000 in your financial, you may have $100,000 home based guarantee.

Domestic guarantee fund will let you use that house security once the collateral to have a unique loan. Its like a personal loan it is protected by your household, that gives your use of all the way down interest rates. Domestic security finance also are both entitled 2nd mortgage loans because they exists while doing so with https://paydayloanalabama.com/clio/ your first home loan.

Generally, domestic guarantee loans allow you to borrow as much as 80 to help you 100 per cent of value of your property, quicker the amount you will still are obligated to pay on your number 1 mortgage.

Meaning, to the brand spanking new $200,000 household analogy, you could potentially accessibility to $160,000 inside the collateral. not, for folks who are obligated to pay $100,000 on your own number one mortgage, then you could obtain to $sixty,000 with an additional home loan.

two types regarding household equity fund

There are two main categories of domestic collateral funds. They each setting somewhat in a different way and gives various other masters. The fresh new Va doesn’t provide either of these financing things, even though one another can be utilized which have good Virtual assistant mortgage.

House equity money (HEL)

A house security mortgage is comparable to most of your financial for the reason that your discover all fund at a time, just like the a lump sum payment, to make monthly premiums into the amount borrowed – generally having a fixed interest rate – through to the financing is paid off entirely.