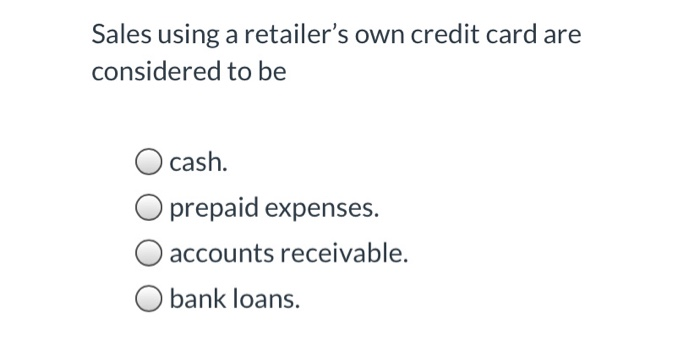

Perhaps one of the most exhausting elements of in search of a home loan is the uncertainty from it all the. When you look at the 2013, throughout the 14% of all domestic get software and you may 23% out-of re-finance programs was denied. It isn’t just an unusual thickness, and it’s really never fun to a get good no off a loan provider, but it is not really the conclusion the world. When you find yourself refused for home financing, you will find things you can do to deal with they to make certain that next time your apply for a home loan, you’re expected to obtain it! Very, what now ? whether your financial software program is refuted?

1: Discover Why

The initial thing you should do is determine what went incorrect, or else you is not able to fix it. If your software program is refused by a lender, federal laws necessitates that they offer a composed negative action observe an effective litter discussing the reason for the fresh new getting rejected. If you don’t understand the need offered, keep in touch with the loan this new administrator and get them to determine the reason in more detail. It is important to totally know very well what the problem is to take the right methods moving forward. You will find several common causes that loan applications was rejected: issues with borrowing from the bank, the fresh appraisal of the property and you will earnings standards. Let’s examine for each and every condition.

Borrowing

Less than perfect credit records is among the main reasons to possess loan software getting turned down. Way too many negative borrowing incidents such skipped or late payments, property foreclosure otherwise small conversion, or bankruptcies, was alarming to help you loan providers. Either a credit card applicatoin try declined even though your credit score try some as well reasonable to generally meet the lenders underwriting criteria. The answer to moving forward here’s, again, knowing the disease. In the event your software is turned down because of your borrowing, you are entitled to discover a totally free backup of the credit report. Finding and restoring any incorrect otherwise incorrect information about the credit declaration is the very first top priority. Upcoming, a very important thing to complete was practice responsible borrowing from the bank activities build your costs timely, cure playing cards with high yearly fees, etc. Below are a few the blog towards fixing your borrowing to find out more.

The fresh new Assessment

Often discover complications with new appraisal off property one results in a denied financial application. In the event that a good property’s worthy of is just too reasonable to help you justify the total amount youre requesting, it may kill the contract. Why don’t we crack it off:

LTV (Loan-to-Value) try a percentage comparing the borrowed funds total the purchase price out of a house, ex: if you would like that loan having $160,000 to find a property for $two hundred,000 (that have a down-payment off $40,000), the fresh new LTV of loan could be 80% this is exactly rather practical to own antique financing.

- The house or property youre to get try appraised inside loan application, together with assessment worth returns in the $180,000, thumping brand new LTV to regarding 89%. Then it a higher percentage as compared to lender will cover, and if you can’t restructure the loan, it may be prevented in music.

Money

Without having enough earnings, or if perhaps your own reputation of earnings isn’t really long enough, or if you has an excessive amount of undocumented money (earnings which you are unable to show in which it https://clickcashadvance.com/installment-loans-oh/cincinnati/ originated in), you will possibly not meet up with the underwriting standards out of lenders. A frequent reputation of income, constantly about one or two spend stubs, otherwise two years’ value of suggestions while you are worry about-working, reveals loan providers that you will be likely to continue to have the newest money needed to repay any mortgage you can get.

Supplies

How much cash do you realy have remaining more than shortly after your own down percentage and you can closing costs? It’s your reserves, and it is usually mentioned on level of days you would manage to create your mortgage repayments in case the earnings would be to run dry. Most of the lender possess more thresholds, but the majority would like you for a least a couple days regarding reserves prior to approving a loan. When your dollars supplies are way too low, you can the bonds including holds, ties, mutual funds, and you can old-age finance just remember that , securities usually are drawn from the a discounted rate anywhere between 60% and you will 70% of its full value; you can also wait and set more money on the discounts, whereby it is important for those finance so you’re able to season by seated on your discounts for a while. Loan providers like to see no less than a few months from no huge deposits otherwise withdrawals to adopt reserves seasoned.

Very, eventually, you can find things that can go wrong and maintain you against getting a mortgage loan, however it is important to maybe not lose hope. Appreciate this the job was rejected and you may do what you are able to resolve people activities and increase your chances of getting recognized, and attempt, is actually, try again! Try with our team begin today!