With all the ICICI Mortgage Rate of interest Calculator, it is very important see the things one to influence your house loan rates. Such items can somewhat effect the month-to-month EMI and you can complete desire payable.

A number of the important aspects become:

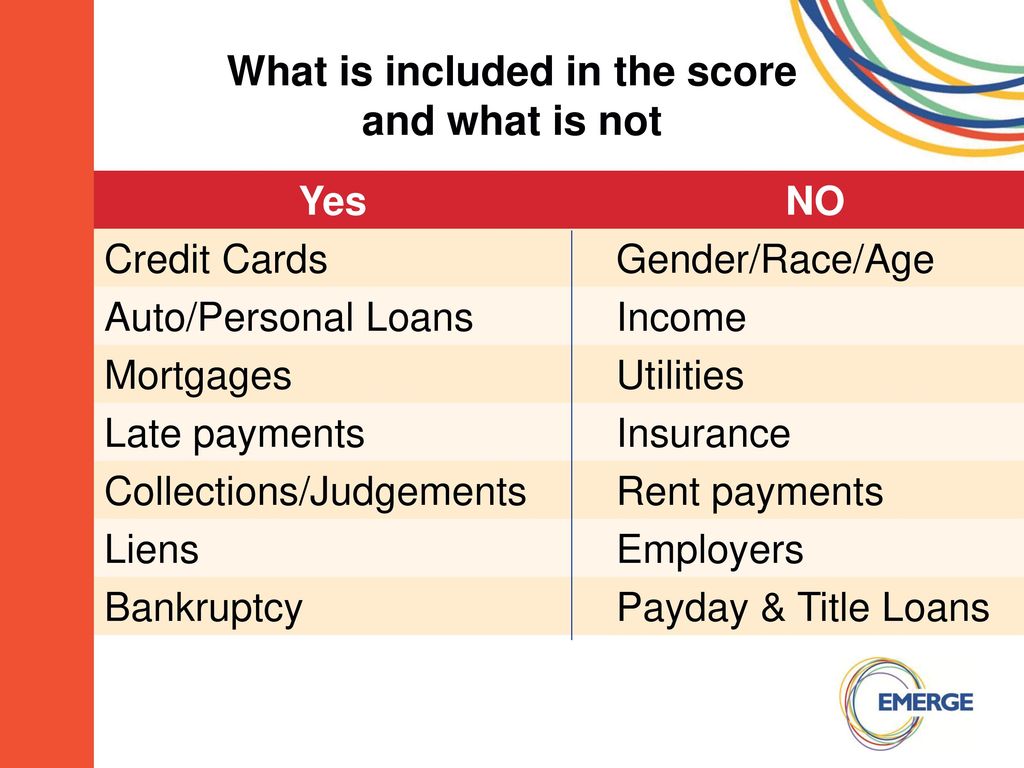

- Your credit score

- The borrowed funds period

- Field criteria

- Reserve Financial off India (RBI) principles

Your credit rating takes on a crucial role for the determining your house financing rate of interest. A higher credit rating helps you safe a lower life expectancy appeal rate, cutting your monthly EMI and you will overall attract payable.

The loan tenure in addition to affects your own interest. Extended tenures will feature large rates of interest, leading to a top total attract payable. But not, nonetheless they result in loans without credit check Hammondville straight down month-to-month EMIs, which could make the loan even more in balance.

Sector Conditions and you may RBI Regulations

Field requirements also can effect your house mortgage interest. In times of monetary growth, rates of interest will get go up, when you find yourself throughout financial downturns, they could slip.

RBI procedures and additionally play a critical part. The RBI kits the repo rate, the speed where they lends in order to commercial banking institutions. Changes in the repo speed is also dictate the interest cost provided by the banks and you will creditors, plus ICICI.

Techniques for Newlyweds: Dealing with Home loan Profit

To own newlyweds, dealing with profit if you find yourself planning home financing is challenging. New ICICI Home loan Interest rate Calculator will be a very important unit within this techniques. It helps you are sure that the fresh new monetary effects of your house loan and bundle consequently.

Brand new calculator enables you to test out additional mortgage number, tenures, and you may interest rates. This can help you pick financing that meets your financial character and you will will not excess your indebted.

Think about, home financing is actually an extended-name connection. It’s necessary to build advised decisions one fall into line with your economic specifications and you can existence.

Balancing Financing Burden which have Economic Think

While using the ICICI Financial Rate of interest Calculator, it is essential to harmony the loan load together with your total economic considered. Think about your other financial specifications and you can loans, such as old-age offers, disaster loans, and you can life costs.

The latest calculator helps you understand how some other loan issues apply at your own month-to-month budget. For example, a high loan amount or a shorter period can result in higher EMIs, that may strain their monthly finances.

Finally, ensure that you reason for upcoming earnings changes. A constant earnings can make it more straightforward to manage your mortgage EMIs or any other monetary commitments.

For the Active Business Elite: Time-Saving Mortgage Investigations

Business benefits often find by themselves small to your timeparing certain financial also provides should be a period-drinking techniques. Brand new ICICI Financial Interest rate Calculator are going to be a lifesaver such issues.

The newest calculator makes you rapidly evaluate more mortgage offers. You could to improve the loan amount, tenure, and you may interest observe how these details apply at the monthly costs and you may complete attention paid back.

This should help you select more costs-active financing provide. It may also help you in discussing ideal mortgage terminology which have your bank.

Utilizing the Calculator to Quickly Evaluate Also provides

To utilize the fresh new ICICI Financial Interest Calculator having brief financing comparisons, start by entering the specifics of the original mortgage render. This includes the mortgage count, period, and interest rate.

2nd, make a note of the determined EMI and total focus payable. Do this again for every single loan provide you with must examine.

Ultimately, contrast the outcome. The mortgage render into the lowest EMI and you may total interest payable could be the quintessential costs-active. Although not, also consider additional factors including mortgage provides, customer care, and bank character.