Replace your credit history

A top credit score indicates in order to lenders you are economically in charge, and there’s the lowest chance that you will not pay back good mortgage. When you can cure loans and construct your credit score, it can be an easy way to score that loan otherwise get way more positive desire and you will payment terms.

If you like that loan right away, enhancing your credit rating is almost certainly not a practical provider as it can take days or many years.

In the long run, enhancing your credit history is a vital economic action for the future funds otherwise monetary potential plus mortgage loans, handmade cards, and you may small company fund. For the majority, building a good credit score can take days or ages, making it a lengthy-label borrowing from the bank method and never an initial-name choice to score financing.

While focusing on gathering the borrowing from the bank or improving your credit rating, MoneyLion has arrived to help! You might create your borrowing from the bank having a good MoneyLion Wow registration. Due to the fact an associate, it is possible to discover the capacity to apply for a credit-Builder Mortgage which is helped over fifty percent of your people Plantsville Connecticut payday loans reviews increase the scores because of the 27 items during the 60 days step 1 .

After you pay off your own Credit-Creator Loan timely, you might decrease your loans-to-earnings proportion and show self-confident percentage background – both of that may help to improve your credit score. By boosting your credit history, you could be eligible for straight down rates into coming funds or refinancing possibilities.

Join MoneyLion Wow membership thereby applying for as much as a $step 1,000 Borrowing from the bank-Creator Financing having an aggressive rates without difficult credit check. You’ll also discover a complete suite out-of MoneyLion WOW’s private advantages, and cashback 2 , VIP sale, and amazing benefits to your favourite MoneyLion items.

Acquire away from family members or members of the family

Borrowing out of household members otherwise family relations are a means to fix providing that loan without a job, however it is maybe not instead of you can easily issues. Family relations or members of the family in a position to offer you that loan you’ll give you immediate access in order to fund. However, make sure you develop the loan words obviously and you will follow toward arranged-up on fees words to prevent straining the dating.

The benefit ‘s the instant access in order to money in the place of a card consider. The brand new downside is the fact it will not be used in your own borrowing report otherwise help improve your credit history when you pay off the borrowed funds promptly. A potential larger downside out-of borrowing from the bank out-of members of the family otherwise loved ones was the potential strain it will apply their relationships. Be sure the brand new friend otherwise cousin was individuals you could cam so you’re able to regarding money and that you follow this new words in order to avoid damaging your own connection with your family.

Imagine a cash advance

A cash loan can be obtained by way of very credit cards. An advance loan limitation is frequently lower than the total borrowing from the bank cards maximum. The rate for the a cash advance can often be a lot higher as compared to apr (APR) to your charge card, very you will be paying much more into the interest about choice. Despite high appeal, the is often below an instant payday loan. When you have a credit card and you will expect you’ll have the ability to settle the borrowed funds number quickly, a cash advance try a means of taking a loan as opposed to employment. Without having a credit, you could nonetheless get one with no employment.

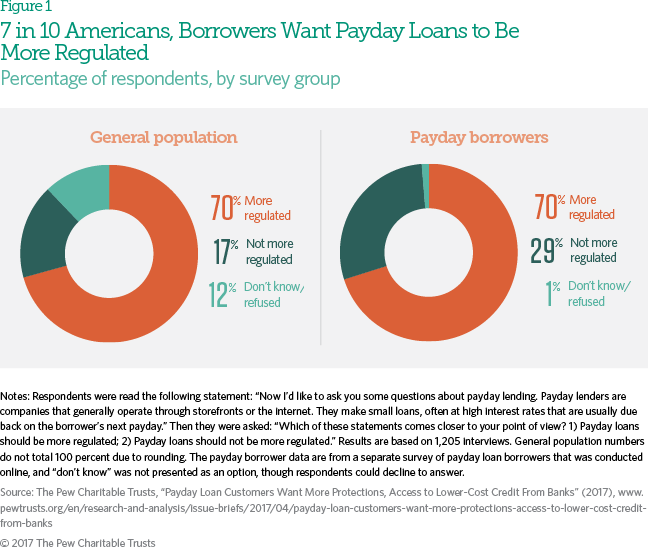

Prevent pay day loan

Pay day loan bring instant cash however they are proven to fees high attention and you can charge and this can be equal to twenty five% or more of the complete mortgage in two days. They have been made to come to individuals who need quick cash who can get struggle to get approved out-of a traditional bank. You’ve got a number of other selection.