- Passaic Condition

- Salem Condition

- Somerset County

- Sussex State

- Union County

- Warren State

The brand new Government Statutes declare that your own bank must opinion a Done Application contained in this a month from acknowledgment. Yet not, that it scarcely goes. Its likely to be that your particular lender will continue to inquire for the very same records and you will recommendations and refuse to comment the brand new app.

Once 30-two months, the lender will most likely point out that your financial documents is actually stale and ought to getting current. That is why it is vital to submit what in step one bundle. It is also important for continue copies regarding the thing that was registered and possess evidence of that was registered of course it are acquired by lender. For many who fill out everything you while the bank wants something different, it could be best if you re also-fill out the complete application toward the brand new recommendations and so the lender provides what you together. It’s very well-known to possess lenders in order to lose documents or perhaps not manage to find the original plan whenever the fresh info is submitted.

Lenders earn more income day-after-day the mortgage is within default, so that they don’t have any incentive to assist residents. You ought to continue a beneficial records, to go to a judge and have you was basically doing your region and bank might have been a failure in order to meet its personal debt.

Do i need to Get financing Modification if i in the morning Currently Underemployed?

Sure, you could potentially get that loan amendment no matter if you will be already out of work. Some Lenders imagine unemployment given that a legitimate pecuniary hardship and you can accept evidence of your unemployment advantages to make costs. Although not, certain Loan providers does not agree a modification if you’re underemployed, due to the fact experts are short-term.

Usually that loan Amendment Stop Property foreclosure?

Sure, getting that loan modification normally stop property foreclosure process. When your lender acknowledges that you have registered an excellent done App for a loan amendment, they want to pause this new property foreclosure way to look at the application. If approved, the loan modification conditions often alter the completely new home loan terminology, and you may foreclosures process is always to stop providing you continue to make the money. For individuals who discovered a temporary (Trial) Amendment, it is told to continue to make those people costs unless you was advised, written down, to quit. Dont stop and come up with costs.

Should i Attention a loan Modification Denial?

Sure, in the event your mortgage loan modification request was declined, there is the to attract. Step one should be to feedback this new denial letter from your own bank, which ought to explanation the reason why into the assertion and gives information towards desire process.

You cannot fill out the guidance to exhibit even more income as an ingredient of your focus. Who would want an alternative application. The goal of an attraction is to try to show them that they produced a blunder from the review of all the information that was registered.

Can i Rating that loan Modification In the event that My personal Financial are Underwater?

Yes, residents with underwater mortgages, the spot where the remaining home loan equilibrium is higher than the latest home’s current worthy of, can invariably sign up for and you will located that loan amendment. Loan providers tend to thought loan adjustment to possess under water mortgage loans as you possibly can become a far more beneficial alternative to foreclosure. For every bank has its conditions, nevertheless the trick is to demonstrated monetaray hardship in addition to ability and work out changed repayments.

What Data Can i Get that loan Amendment?

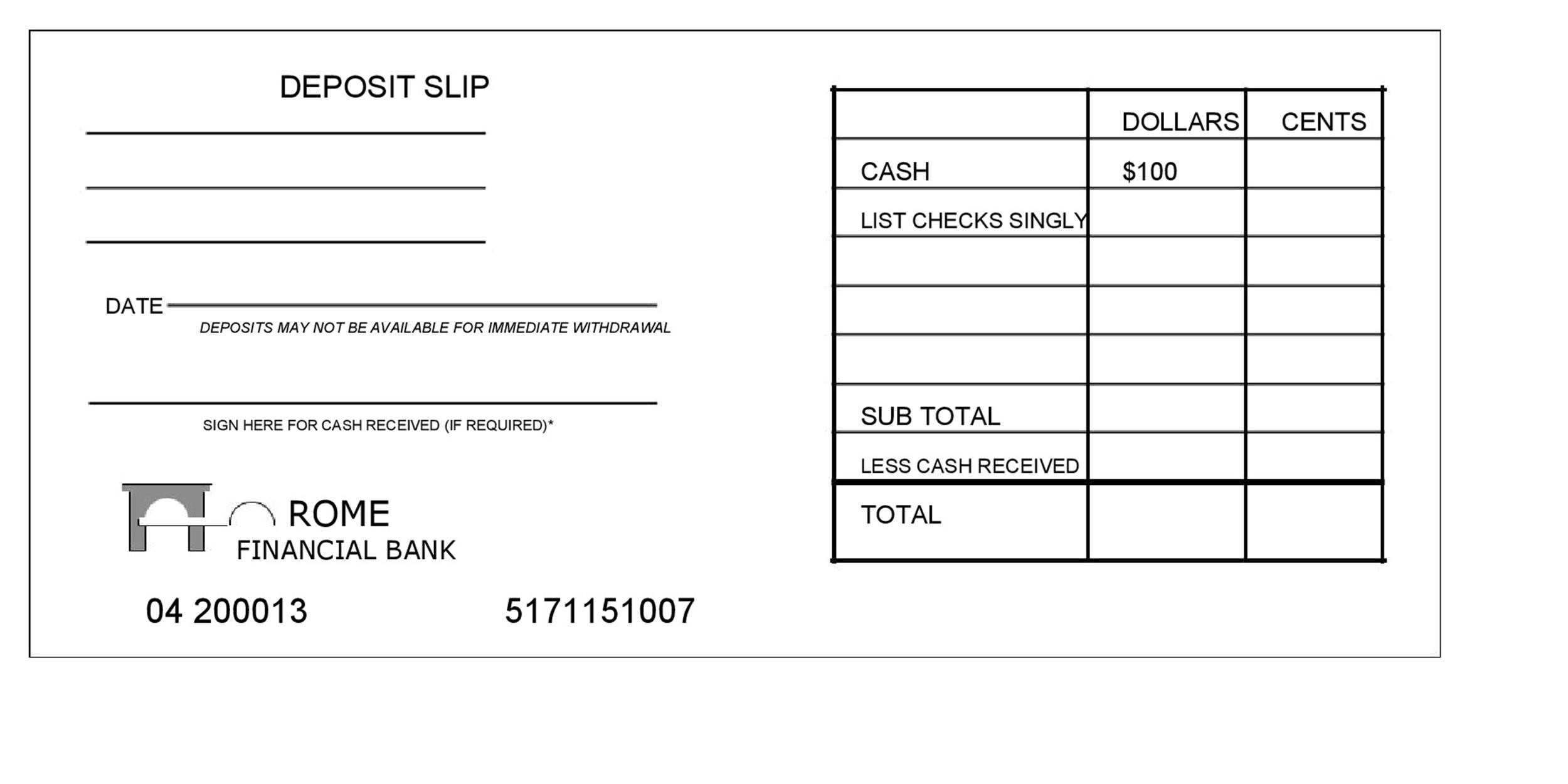

Whenever applying for a loan modification, it is essential to give every related pointers in one single plan to help with the application. This new data always expected were:

? Proof income: This is exactly current shell out stubs, tax returns, or other monetary comments that demonstrate your revenue. ? Reasons away from pecuniary hardship: A written declaration discussing the newest affairs which have impacted your capability to make typical home loan repayments. ? Present financial statements: Constantly, lenders inquire about the online personal loans LA very last 2 to 3 months to assess your financial updates. ? Factual statements about monthly expenses: This helps loan providers gauge your financial obligations.