It is very important work at a good Virtual assistant-accepted bank even though you have significantly more entitlement on your COE

- Influence this new extent of your own enterprise: Before applying to possess good Virtual assistant Structure Financing, it is critical to has actually a very clear comprehension of the fresh range of your own home improvements otherwise additions you want and also make. This can help you guess the expense of the project and you may see whether good Virtual assistant Build Loan is the correct choice for your position.

- Focus on a Virtual assistant-recognized specialist: Getting entitled to a Va Framework Mortgage to possess renovations otherwise improvements, attempt to run an effective Virtual assistant-approved contractor just who meets the newest Institution out-of Experts Affairs’ standards having framework top quality and you may shelter. The bank helps you find a professional builder in your town.

- Get all needed it permits: Depending on the extent of your venture, you may need to see it allows from your local strengthening agencies. The specialist can help you figure out which it permits are expected and you may make sure all job is completed in compliance which have regional laws and regulations.

- Budget for unforeseen will set you back: Home improvements and you may enhancements can occasionally learn unanticipated things or costs. You will americash loans Margaret need to cover this type of contingencies to quit delays or unexpected expenses.

- Plan for occupancy: If you plan to live in your house while renovations or improvements are being generated, you will need to policy for brief life plans for the construction several months.

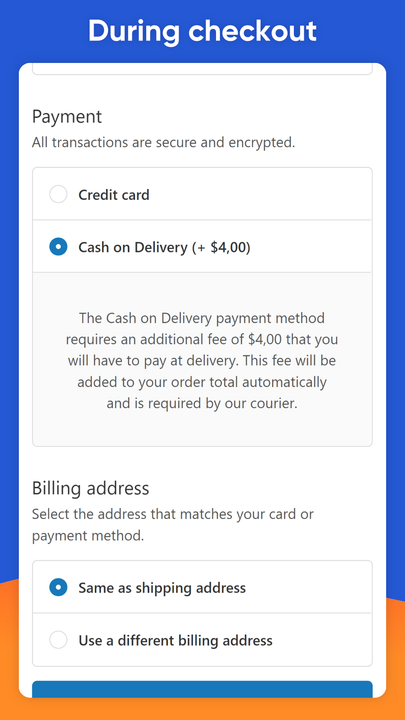

- Policy for the loan payment: Make sure you possess a repayment bundle in place before you take a loan, this new cost several months to have Virtual assistant Build Loan could be longer than antique funds.

By following these types of steps, you could let be sure a softer and winning renovation or inclusion venture playing with a good Virtual assistant Framework Loan.

Construction Va Loan limitations

If you have complete entitlement, you don’t need to a threshold toward mortgage. This is why you can borrow as much as you want to create your residence, so long as you meet with the lender’s requirements. not, when you have left entitlement, you do have a home loan restriction. It limitation will be based upon new state in which you bundle to create your residence, also it can include one destination to another.

Money fee: Va finance generally speaking want a funding commission, which is a single-day fee paid back because of the borrower to simply help counterbalance the pricing of your own Virtual assistant mortgage system. Having Build Fund, the latest resource commission try 2.3% of your total loan amount. Creating offers quicker funding fees as little as step 1.5% depending on which utilize that is to possess funds designed to buy otherwise construct a home with a down payment of at least four % of your own price. This alter implies that consumers will pay less financing fee compared to the past decades. New percentage design brings an installment-preserving chance of pros and you may productive-duty services participants who will be eligible for a good Va loan. It is critical to note that the reduced resource charges is only going to apply at financing closing with the or after . This article is merely a little taste of your own the latest funding charge released this present year, see our posts on the Virtual assistant Loans to see current suggestions and you can a far greater understanding of exactly what mortgage charges was.

Minimum property standards: The new Va possess certain standards to possess features which might be qualified to receive Va funds, as well as Design Financing. The property should be home-based, possess a certificate regarding occupancy, and you can satisfy lowest requirements to have defense, practices, and you may structure quality.

- The house or property must be secure, structurally voice, along with compliance with regional strengthening rules.