- Pay attention to the eligibility standards and value before getting a beneficial 2nd possessions.

- This new recent increase in A lot more Buyer’s Stamp Duty (ABSD) function you’d you would like way more cash when buying the next home.

- To find a second possessions comes with more financial responsibility; its informed as clear regarding your purpose for selecting the following possessions

That have inflation dominating statements during the current weeks, rates of interest are prepared to increase subsequent on coming days. When you yourself have been likely to and acquire another possessions, this can be a great time to start looking just like the an excellent boost in interest might just mean stabilisation of possessions pricing.

Besides the price of the house, there are some something you would should be mindful of when to order the second domestic, for example qualification, value and you will intent.

Eligibility

If you own a personal possessions, then you will be liberated to buy the next personal assets with no courtroom implications. But not, in the event your earliest house is a community property, whether it’s a create-to-Buy (BTO) flat, resale HDB apartment, professional condo (EC), or Design, Generate market Plan (DBSS) flats, then you’ll definitely need to fulfil particular standards before your purchase.

HDB flats have a beneficial 5-seasons Minimum Job Several months (MOP) demands, which means you’ll need to reside you to assets having an effective at least five years before you can promote or rent your flat. You will additionally need certainly to fulfil the fresh MOP up until the buy from an exclusive assets.

Would note that only Singapore people can individual both a keen HDB and you may an exclusive assets meanwhile. Singapore Permanent People (PRs) will have to get out of their flat within this half a year of your own private assets purchase.

Cost

Characteristics are known to become notoriously pricey inside Singapore and you will cautious calculations need to be built to make sure your second property purchase stays sensible to you personally. You would need to take note of your own after the:

You might have to pay ABSD when you get a moment home-based assets. Extent you would have to pay hinges on their character.

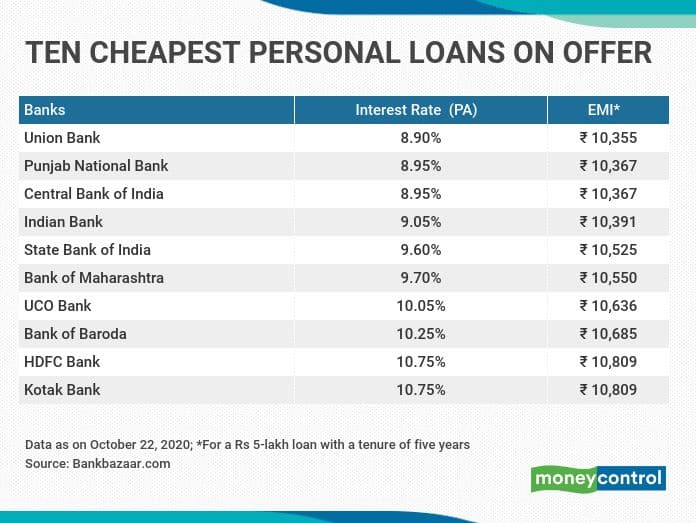

The newest ABSD is past adjusted toward within actions to bring a sustainable assets markets. Current pricing is reflected on the desk less than:

Considering the latest ABSD pricing, a beneficial Singapore Citizen which already is the owner of an HDB flat but desires to shop for a personal condominium costing $one million should pay a keen ABSD of $200,000 (20%). Would keep in mind that this count is found on the top client’s stamp responsibility.

The first domestic pick means just around 5% dollars down payment for folks who used a bank loan, your second assets need a 25% cash advance payment of your property’s valuation restriction. Offered a property that is appreciated on $1 million, you would need $250,000 cash getting down payment.

The total Obligations Servicing Ratio (TDSR) build was produced onto end homebuyers away from borrowing from the bank too much to invest in the purchase regarding property. Beneath the construction, home buyers can just only acquire to help you up 55% (modified into the ) of the gross monthly earnings.

For those who have home financing associated with the first possessions purchase, it can considerably change the number you could acquire for your second domestic. Although not, when you have already cleaned the loan on the very first house, then you’ll just need to ensure that your monthly homes loan money also another monthly https://paydayloanalabama.com/graysville/ financial obligations dont go beyond 55% of the monthly income.

To suit your basic housing mortgage, you are eligible to borrow to 75% of the home worth when you’re using up a financial loan otherwise 55% if your mortgage period is more than three decades otherwise expands previous decades 65. For the 2nd homes mortgage, the loan-to-well worth (LTV) ratio drops in order to forty-five% having loan tenures as much as 3 decades. If for example the mortgage tenure surpasses twenty five years or your own 65th birthday, the LTV drops to help you 31%.

As you can plainly see, to find an additional assets if you are nonetheless purchasing the borrowed funds of your first house want a great deal more cash. Based on property valuation of $1 million, you’ll likely need:

While it’s you’ll to utilize their Central Provident Fund (CPF) purchasing another assets, when you have currently used your CPF to you personally basic domestic, you might just use the extra CPF Average Membership coupons to possess your next assets once setting aside the current Basic Later years System (BRS) out of $96,000.

Purpose

To order an additional assets boasts way more economic obligations as compared to very first one to, and is also informed is clear concerning your mission for buying the next assets. Could it possibly be to own resource, or have you been deploying it just like the another family?

Clarifying the mission allows you to to make particular choices, including the style of assets, as well as opting for an area who finest match its objective. That is especially important in the event the next home is a good investment possessions.

Like most almost every other assets, might have to work-out the possibility local rental give and you will capital really love, plus dictate the new projected profits on return. As property get is an enormous money, it’s adviseable to have a technique you to definitely imagine affairs such as for example:

What exactly is your investment vista? Could you aim to bring in money immediately following 5 years, or even to keep it toward long-term to get lease?

Whenever and just how would you clipped losses, if any? In the event the home loan repayments was greater than the reduced rental income, just how long do you really wait in advance of selling it off?

To find a house for the Singapore is money-intensive and purchasing another family will need much more monetary wisdom. People miscalculation might have extreme monetary effects. Therefore, create a definite plan and you will request an abundance considered movie director to help you having possible blind locations.

Begin Planning Now

Here are a few DBS MyHome to work out brand new amounts and get a house that fits your finances and you will choice. The good thing it cuts out of the guesswork.

As an alternative, ready yourself with a call at-Idea Recognition (IPA), so that you enjoys confidence precisely how much you could acquire to have your house, letting you see your financial allowance precisely.