When looking at housing choice, are designed homes was a popular possibilities among home owners inside Washington. If you are looking within to purchase property soon, you will need to begin contrasting your money possibilities, particularly when provided a manufactured family. Are available homes enjoys additional criteria of conventional website-centered residential property, therefore it is essential to see your options before making a decision toward an effective family. One of the solutions would be an FHA are built mortgage.

What is actually an FHA Financing?

Brand new Government Houses Administration, or FHA, try an integral part of this new Institution out of Housing and you can Metropolitan Development. The newest FHA provides mortgage loans financed from the an approved FHA bank compliment of an FHA mortgage . FHA financing are created to assist borrowers on the lower-to-average earnings bracket. These types of funds generally speaking require a lower life expectancy advance payment than just old-fashioned finance and supply a whole lot more flexibility within the being qualified based on fico scores.

FHA finance might need as low as a step 3.5% downpayment rather than the 20% traditionally necessary for a conventional lending company. You might be in a position to qualify for an FHA financing, no matter if your credit score is simply too lower to be qualified to own a vintage home loan.

Depending on the brand of FHA loan you will be trying to get, degree requirements can differ. Usually the conditions to have an FHA loan recognition is:

- Income. You need to offer proof of current money.

- Credit . The fresh new FHA financial tend to check your credit rating and you will credit rating.

- Bills. They’re going to consider any other financing, credit debt, or other expense.

- Security. They’ll appraise any equity you have regarding property otherwise almost every other qualities.

- Loan amount . The lender will appear during the full matter we would like to obtain with the home.

The house is employed since your number 1 household so you’re able to be considered for an enthusiastic FHA financing. It is critical to observe that FHA lenders provides limitations on the matter you could obtain, and they will will vary because of the condition or shall be according to home will cost you in your neighborhood you intend to obtain brand new house.

What forms of Were created Residential property Meet the requirements To have a keen FHA Financing within the Washington?

Several kinds of are available otherwise cellular belongings can be found, and it is necessary to understand and that version of these types of land meet the requirements having an enthusiastic FHA mortgage in Washington. Single-broad, double-greater, and you will multiple-wider were created and you will standard belongings is eligible for FHA funds. Mobile land are designed before June 15, 1976, will not qualify for an enthusiastic FHA financing. Brand new are created homes direction changed after that, and you can belongings were created just before you to definitely go out do not follow the latest this new advice.

What’s a created Home?

The brand new Federal Property Management talks of a created house because the any prefabricated family that can easily be transmitted in order to a place in one single or significantly more sections. It must be 40 base or offered and also at least 8 base large into the travelling means. Were created house range from the framework house of the assembly strategies used, with respect to the FHA. The new design home manufactured 100% on-webpages throughout the crushed right up, whereas prefabricated land are built partly or entirely in the a factory-sorts of mode, off-webpages.

Are made land is actually partly come up with away from-web site immediately after which later transferred to a precisely place place. There might be a lot more construction with the house accomplished shortly after these types of pre-put together pieces come. The past build will be finished from the structure businesses, strengthening contractors, or individual laborers. Additionally, you will need a plumbing professional and you will electrician link our home to your sewer program and local power source.

One-wide manufactured residence is 18 legs otherwise quicker in width and you will ninety legs or smaller long, which have a double-wider priced at 20 feet wide once the a minimum without more than 90 foot long. A single-greater are designed home could possibly be the prime beginner home otherwise old age house as it is reasonable and you will under control in proportions. Were created residential property one qualify for FHA funds were constructed shortly after June fourteen, 1976, and you can meet with the advanced away from security and structure rules necessary from the HUD for prefabricated homes.

You can financing were created property having fun with a good chattel financing . Chattel finance cover individual property which might be went, instance devices, auto, and you may are formulated land. The home acts as guarantee towards the financing payday loan Huguley, like a timeless financial. not, for folks who individual new are available house’s belongings and you may default toward chattel financing on are available domestic, the financial institution can only just repossess our home. Washington now offers FHA chattel fund to possess are produced land.

What’s a standard House?

An alternative choice for good prefabricated home which can be eligible for an FHA loan when you look at the Washington is actually a standard house. Such residence is as well as created of-webpages however, differs from are manufactured of those because it’s wear an effective long lasting basis and won’t move. As this particular prefabricated loan is actually permanently grounded towards the land its located on, you could loans a modular household through a timeless home loan, together with an enthusiastic FHA alternative.

You just take a loan away into standard home for many who currently very own brand new homes. For individuals who have not purchased the new block of land yet ,, then you can are the end in the loan, and at the termination of the latest loan’s lives, you can own both household therefore the house outright. The advantage to that would be the fact you are not paying home lease even after you possess the house.

Of a lot prefabricated property provide an appealing external, good structure, and you can an appealing indoor that have progressive devices and you will accessories. Were created and standard property get more complicated to help you discern away from the newest framework, and often immediately after inside, you can’t really give the home is actually a beneficial prefabricated dwelling.

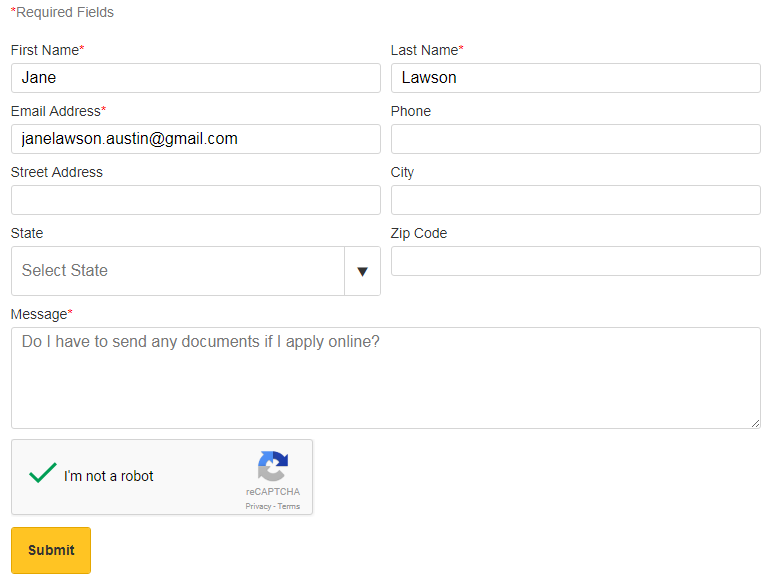

If you are searching to purchase a good prefabricated house when you look at the Arizona, reach out to new educated party during the Cascade Monetary Characteristics. I happily suffice the Phoenix city. We would love the opportunity to answer any queries you have, speak about financing choice to you, and just have you pre-certified to help you initiate the fresh new choose your perfect house. You could potentially started to us from the 877-869-7082 otherwise thru our convenient and you may safer online messaging system. Cascade Financial Features can help you build Washington your house.