Cook County

Seeking a property into the Cook State? In the event the get together money getting a downpayment is the merely question status on the means, Wintrust Society Bank possess a Homebuyer Give System that provide earliest-time homebuyers having $dos,one hundred thousand within the free cash to aid.

Joliet

When you find yourself interested in a different sort of home within the Joliet, check out the city’s Deposit Guidance System, that offers reduced-money homeowners which have financial help worth as much as 20% of residence’s purchase price. Minimal advance payment help is $step 1,one hundred thousand. The latest funding emerges in an excellent 0% notice, deferred percentage loan. It’s forgivable, and that means you may not have to pay they back!

Homebuyers need to dedicate $dos,five hundred of one’s own funds for the residence’s pick. Every construction brands, and were created land for the a fixed foundation qualify. Really the only exception was home found in the 100-year flooding basic and those that try renter-occupied.

Kane State

Kane County even offers a first-Day Homebuyer Financing Program giving homebuyers which have around $10,100 into the downpayment assistance in the way of good 0% notice deferred fee mortgage. You will not shell out one to penny of great interest while don’t possess to blow one thing straight back if you don’t promote your property, transfer the brand new title or no offered make use of the house as your first household. You could sign up for another $10,100 during the advice if for example the house is inside the area restrictions out-of St. Charles.

To be considered, you must live otherwise functions complete-date within the Kane State. An essential caveat is you need to have existed from the county for at least 12 months in advance of distribution a credit card applicatoin. You should not go beyond federal income restrictions, and can need done homebuyer guidance. Next, you need to build a deposit with a minimum of 1% of your own home’s price.

You buy is going to be a detached home, townhouse, or condo nonetheless it has to ticket a general visual inspection and you can a contribute-created color assessment.

Kankakee

Kankakee has its own Homebuyer Incentive Program otherwise KHIP that gives $2,five hundred grants for the a first-come, first-supported foundation. It is arranged to own reduced- in order to reasonable-earnings group buying belongings for the lower- to reasonable-earnings census tracts.

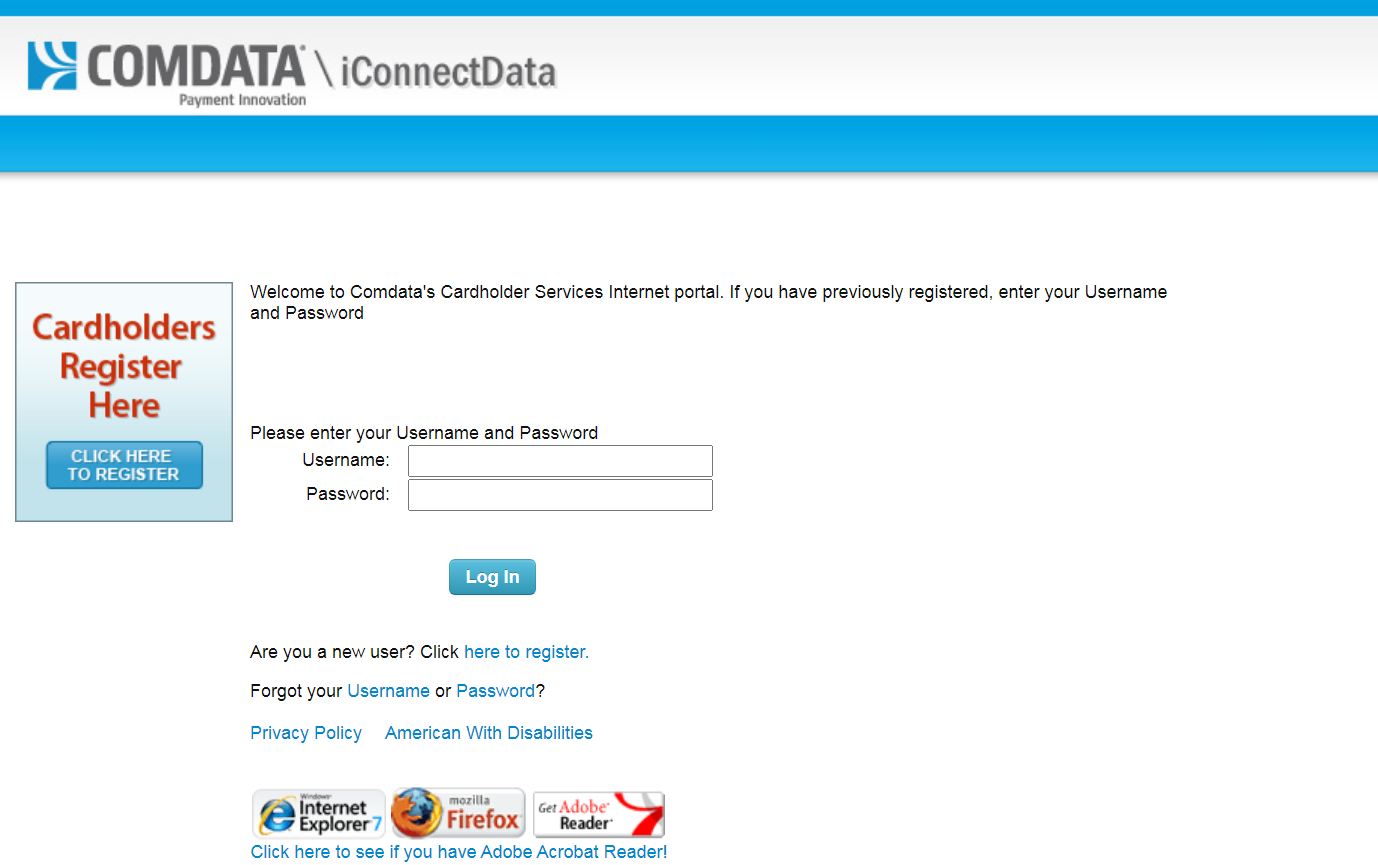

You’ll need to see earnings conditions and you may complete good homebuyer training path. Find out snap the link right now more on the city of Kankakee site.

Madison Condition

Madison State works good Homebuyer Program which provides 5-12 months forgivable funds all the way to $5,100 so you’re able to very first-time homeowners whom meet income advice. You will need to earn more or less 80% otherwise less of this new county’s city median earnings to-be eligible. You also have to invest in staying in your house for within the very least 5 years since mortgage is forgiven simply once five years’ occupancy.

Homebuyers must over an effective homeowner’s knowledge direction, features a credit score with a minimum of 620, in addition they need one or two years’ constant earnings.

Regular

While you are family-looking in Regular, imagine trying to get the brand new town’s homeownership guidance program that may offer you that have a good $step 3,one hundred thousand grant to help with your advance payment and you may settlement costs. The application form has been performing for pretty much a couple of ilies purchase an excellent home.

This is a requirements-centered system so you don’t have to feel a first-big date homebuyer. Instead, you will need to demonstrate that you wouldn’t be able to be considered to have a mortgage without which financial assistance. The latest features are supplied for the a primary become, basic supported basis.

Rockford

Looking to purchase an alternate domestic from inside the Rockford? Look into the Homebuyer Direction System, that’ll present financial help all the way to $15,100000 within the a great forgivable loan. The new offer matter is dependant on your revenue, loans and envisioned mortgage.