Benefit from HELOC’s Power

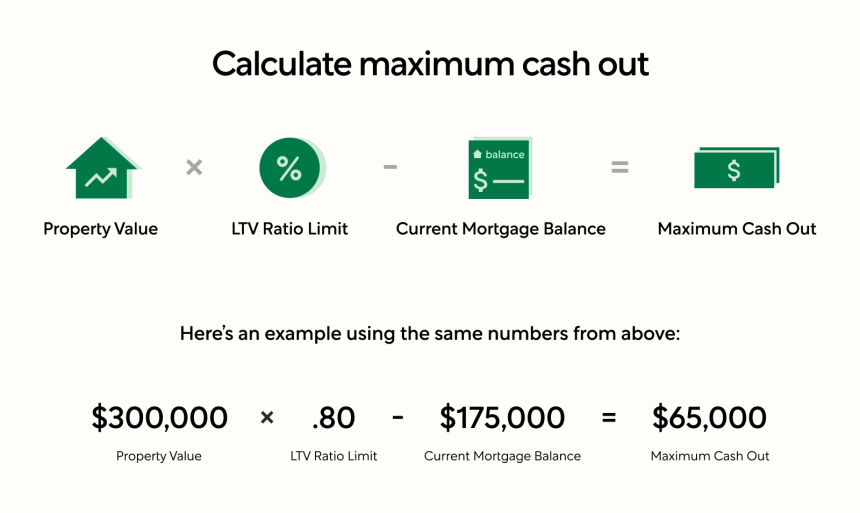

Property guarantee credit line (HELOC) feels as though with a credit card which is safeguarded because of the worth of your house. Such a credit card, home security loans has a borrowing limit. You to limitation is frequently calculated at the time your unlock brand new membership according to the value of your residence and you will what is actually still due to the first mortgage.

What’s Equity?

Collateral ‘s the property value your property without any expenses one to take place facing it. For many who pay down your own financial from the $500, you have a supplementary $500 value of security in your home (while the significance is not less than your balance on your own mortgage).

Strengthening guarantee is amongst the most readily useful arguments for possessing a great home in place of leasing that. The money you pay month-to-month into your mortgage is still your own personal and you have it when you offer the house. If you would like dollars but do not should sell your residence, one to choice is property equity personal line of credit.

A property collateral credit line (both shortened so you can ‘HELOC’) feels as though having credit cards which is protected because of the value of your house. For example a credit card, family security financing has a credit limit. You to maximum often is calculated during the time you open the brand new membership according to the worth of your property and you may what is nevertheless owed towards the first-mortgage.

Family collateral credit lines are typically best for a certain name, generally 10 to 15 years, and often features an excellent ‘draw period’ that enables that need cash on the loan through the years, unlike at a time.

The first advantageous asset of using this type of credit line is that appeal is normally income tax-deductible. The danger, is the fact incapacity to repay you could end up property foreclosure. To eliminate one, envision some traditional errors someone make which have household collateral lines regarding borrowing also specific reduced-chance possibilities they could render if handled responsibly.

Do: Alter your Home

One of several safest expenditures you could make that have a property security credit line are remodeling or enhancing your house. Installing the new devices, plastic material exterior, otherwise energy conserving windows pays returns both in the increased property value your house and also in your wellbeing. The cash you have placed into your home will get pay back whenever your sell.

Don’t: Consider it due to the fact “100 % free Money”

Among the secret reasons for the new sub-best mortgage crisis is actually punishment from domestic guarantee finance. Anyone perform invest recklessly with the collateral within their house. They asked the worth of their residence to permanently continue along with their level of purchasing. Whether it don’t, it found by themselves owing additional money to their homes than simply they was indeed value, there wasn’t adequate credit (otherwise really worth) yourself in order to refinance. Investing your home equity to finance your life style is a lot like consuming your home down to stand loving on the winter. It’s going to work for a bit, but you will remain as opposed to a destination to real time.

Do: Consider it as a crisis Financing

One of the smart-money models regarding financially profitable anyone was establishing a small pond from savings to fund unforeseen calamities like job loss, vehicles repairs or major disease. With it deals enables them to prevent going also heavily with the debt if a person ones disasters happens. You can make use of your property collateral credit line during the a equivalent ways. Even though it is maybe not a fantastic disaster financing, it is a far better wet big date address than playing cards, payday loan otherwise auto title finance.

Don’t: Utilize it to cover Vacations, Earliest Expenses, or Deluxe Facts

You have worked hard to create the security you really have for the your property. Don’t use it to your something that does not assist in improving debt position in the long run. Never use your property equity credit line to pay payday loan Padroni for first expenses such dresses, groceries, tools or insurance rates. And, around we-all you would like you to definitely trips, you are best off protecting for it than just spending money on they on equity of your house. At exactly the same time, avoid using your domestic equity credit line on deluxe points that lose the well worth whenever you bring her or him family.

Do: Use it first off a business

If you’ve been contemplating beginning a business, you truly already know just one to money one dream shall be an excellent fight. Your residence collateral line of credit may help purchase certain of your own start-right up costs. You can use it in conjunction with grants and you can business financing to help you diversify the exposure. The good, versatile repayment terms minimizing rates of interest can make which an excellent viable choice for your campaign.

Provided property collateral loan? You can read throughout the Cap COM’s home collateral personal lines of credit and check our most recent cost here or call (800) 634-2340 to talk to a person in all of our Financing Team, who’ll reply to your issues that assist you know your options.