Credit rating expertise, which use guidance in your credit history to test your own possibilities from failing continually to repay that loan, play an important role in a lot of lenders’ assessment out-of debtor risk. But they are an individual equipment lenders play with when choosing what rate of interest to help you ask you for.

When considering financial software, lenders typically have fun with credit ratings to own a good “very first admission” testing of creditworthiness, after that research behind this new ratings by using a cautious evaluate the credit file or other monetary suggestions

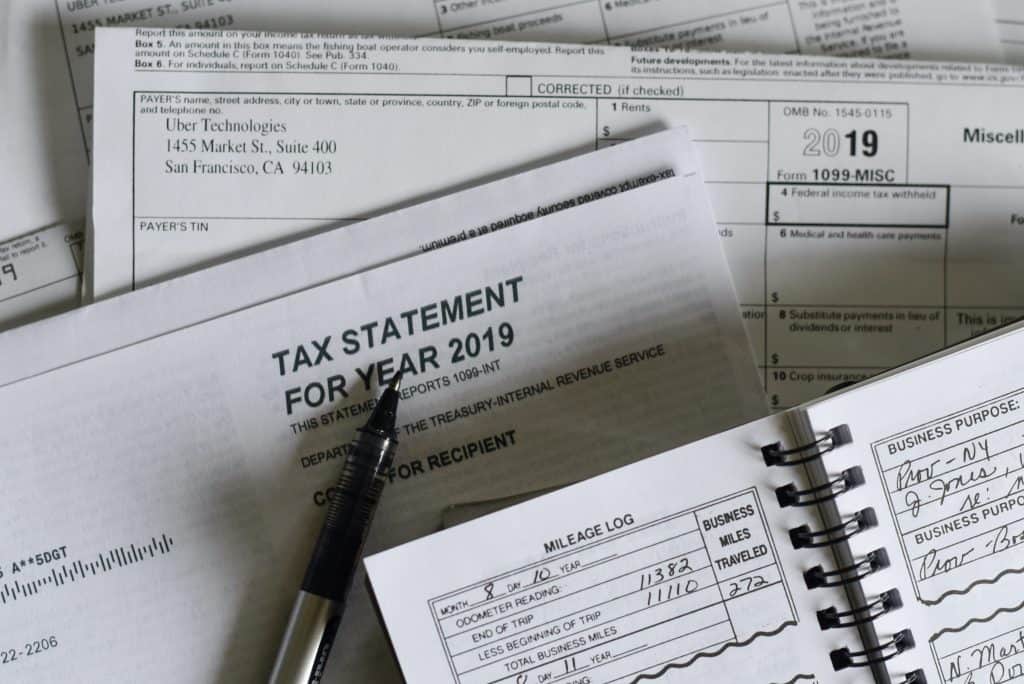

- Debt-to-earnings ratio: Lenders normally want proof of income in the form of shell out stubs or tax returns, and in addition they absorb your own a great expenses and extent you only pay loan providers every month. Debt-to-income (DTI) ratio, the newest portion of the month-to-month pretax money one would go to loans repayments, is an important gauge of your own ability to safeguards the fresh bills. Since your DTI ratio expands, so really does your seen exposure; higher DTI percentages could possibly get for this reason render higher notice costs.

- Deposit: Traditional mortgage brokers like a downpayment of 20% of one’s home’s price, but some loan providers allow you to generate a diminished down-payment. They typically charges large interest levels due to the fact a good tradeoff, who may have that buy individual financial insurance (PMI) to safeguard him or her facing economic lack of instance your are not able to pay back the mortgage. Conversely, if you possibly could set-out over 20% of your own price in advance, you might be able to discuss a diminished interest rate.

- Financing name: Generally speaking, you can aquire less interest rate for those who find (and you will qualify for) that loan which have a smaller repayment name-an effective 15-12 months financial instead of a thirty-seasons one, for example. Your provided loan amount, a smaller-label financing brings large monthly premiums but lower full notice can cost you.

Credit scores is actually a great distillation of the information on the borrowing from the bank reports, and this document your own reputation for borrowing money, playing with credit and you can and also make financial obligation money

Therefore, before you apply to have a mortgage, it is wise to need a careful look at the individual credit reports regarding all the about three national credit bureaus (Experian, TransUnion and Equifax). Doing so makes it possible to spot and you can best wrong records that generate a negative effect (and lower the credit ratings), and will together with make it easier to invited and you can prepare for questions loan providers might have regarding your credit score. You should buy a totally free credit file regarding Experian, TransUnion and you can Equifax during the AnnualCreditReport.

In terms of home loan applications, loan providers normally use fico scores getting good “earliest citation” review out of creditworthiness, up coming research trailing brand new score if you take a mindful look at the credit file and other financial information

- Later or skipped costs: This new effects of later payments on your credit score fade over time, therefore a belated commission made in the past might not have a big affect your score, but it you may provide a loan provider pause. You could probably describe out an isolated event because the an honest mistake, if your record is sold with several missed costs, you may need to promote a very detailed account-and you may a conclusion regarding exactly how you’ll be able to end repeating those individuals missteps into the the near future.

- Charge-offs or profile when you look at the range: When the a loan provider is unable to assemble a loans from you, they may personal your bank account (a method also known as a fee-off) or offer the debt to help you a portfolio service, which assumes on the legal right to follow your to the unpaid fund. Charge-offs and you will range entries stay on the credit reports getting eight age. Even if you at some point pay the collection agencies (or even the new creditor), the presence of such records in your credit history you’ll discourage a mortgage lender.

- Significant derogatory entries: If your credit report includes a mortgage foreclosure, car repossession otherwise bankruptcy proceeding, loan providers will in all probability come across red flags. Are common proof personal debt which had been not paid off centered on new financing preparations-facts one to naturally create loan providers careful. These types of entries is also stay on their credit reports getting 7 in order to ten years, which have old records recognized as faster annoying-and therefore less harmful to their credit scores-than newer of them. Still, when you have some of these records on your own credit history, specific mortgage lenders may begin down your loan app altogether. Lenders ready to consider carefully your software commonly anticipate that identify the fresh new bad entries, and show facts as you are able to avoid equivalent affairs shifting.