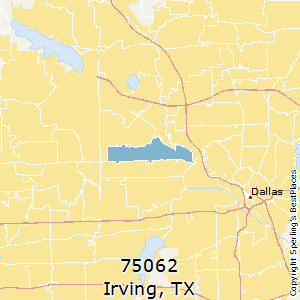

Reside in an excellent USDA-approved locationTypically, if a home try attached to a location Zip code, it will not qualify, but residential district section outside a major city you may. The newest USDA’s property qualification chart contains the most satisfactory facts about qualified and you may ineligible parts for guaranteed and you can head fund supported by the fresh USDA.

Many people are surprised to determine what counts because the outlying. Particularly, Readington, New jersey, is actually appointed once the a qualified outlying area, which can be no more than an hour or so exterior New york city.

Condition off homeHomes bought having USDA funds must be right up-to-go out away from safe practices functions. The fresh new government purpose of the new Single Family unit members Casing Protected Loan Program was to provide lower- and you will modest-money persons who’ll live-in outlying elements having chances to own decent, as well as sanitary dwellings and you can associated organization. You won’t be able to take-out an effective USDA mortgage to possess a property this is simply not considered decent, as well as hygienic by USDA standards.

This suppress folks from taking out fully a USDA financing to blow for the a home they will not indeed are now living in. The new USDA along with disqualifies doing work farms because entitled to financing apps.

- Power to generate monthly paymentsWhen researching the creditworthiness, lenders will thought employment history, income and you will assets. You should be capable show that their month-to-month homeloan payment would not go beyond 29 % of the monthly earnings. Really lenders need to see proof a steady money and you may a position for at least two years. You will not qualify for a great USDA loan if you have been frozen out of another federal program.

USDA loan positives and negatives

Spending $0 down on property having a long fixed-rate label audio best for just about anyone. However, there are several drawbacks to look at also, such as in accordance with qualification criteria and processing lengths.

USDA financing benefits

- $0 down paymentUSDA gives the merely kind of mortgage system you to lets you roll settlement costs on the loan, this is the reason one may loans 100 percent of house purchase, and additionally upfront fees and personal mortgage insurance rates (PMI).

- Lower repaired-price interest ratesWhen you have made a fixed-speed label, it’s not necessary to love the prices broadening through the years. All USDA loans are available more 15- otherwise 29-year terms and conditions. As with other kinds of finance, going for a smaller name period will make your own monthly obligations higher if you find yourself a lengthier label will pass on money over to a great deal more big small personal loans Cleveland UT date, ultimately causing less invoice.

- Less home loan insuranceMost lenders wanted home loan insurance to get paid monthly. Annual home loan insurance premiums having USDA loans average only 0.30 percent, the reasonable of any home mortgage system (except for Va, and this does not require home loan insurance rates at all)pared so you can FHA fund, financial insurance costs are about $a hundred quicker per month for USDA financing.

- Flexible credit standardsSince USDA money are created for individuals who cannot qualify for more traditional mortgages, loan providers may take on applicants having spotty borrowing from the bank histories. Consumers could probably expose alternative tradelines, for example cellular phone bills, to help you portray its fee records.

- No early incentives otherwise prepayment penaltyThe USDA wouldn’t punish your if you make large payments. If you’re able to, paying a beneficial USDA mortgage very early might be beneficial. You can shell out reduced desire to your financing through the years, acquire security in the home quicker and find out a better roi.

USDA financing drawbacks

- Tight eligibility and you can degree requirementsEligibility criteria was points like the venue of the home we need to get and you will income limitations for one town. Being qualified standards have to do with your credit score, debt-to-money proportion and you will ability to pay off.