Will you be curious how to get financing to have a mobile house? Find out about the kinds of fund available, how-to evaluate your bank account, and how to find the best financing.

Another are made family costs on average $76,eight hundred for just one create for the e time, according to the U.S. Census Bureau. Should you be offered to purchase a cellular house, this is exactly good information getting, and you may luckily discover financing offered to help anyone fund a cellular, otherwise were created, home. Exactly how difficult is it to acquire that loan to own a cellular house? That will depend on everyone customer’s specific problem. It is important to have mobile home buyers to understand what particular finance are available, simple tips to assess the finances to determine what kinds of financing are around for him or her, and the ways to see thereby applying for the best mobile domestic fund. Proceed with the steps less than, which will show you how to find a mobile family having fun with financing.

Before you begin…

The difference between a mobile family and a created family normally be a common point from frustration to have customers, nevertheless variation loan places Jacksonville is largely simple. Getting sensed a cellular household, it must have been facility-founded ahead of the introduction of the Federal Cellular Household Construction and you may Security Requirements Operate out-of 1974 and HUD Are built Home Build and you can Safety Standards introduced during the 1976. Are available home are those that were facility-founded immediately after 1976 because the brand new safety conditions was commercially for the lay. Lenders commonly stop funding pre-1976 cellular house because they are smaller as well as there clearly was more opportunity your domestic would-be broken otherwise missing. However, in spite of the distinction, the newest terms and conditions mobile household and you can are created household usually are put interchangeably.

It’s also important to remember that a cellular home loan are not the same as a vintage home loan. As an example, some software may have more strict income limitations. The house will also have to meet up with specific requirements. For-instance, whether your home is with the tires, it might be considered once the a car, which can impact the loan sort of. There is going to be also dimensions requirements towards family and different categories based on the base, for starters.

Step one: Evaluate your finances to discover a free budget.

![]()

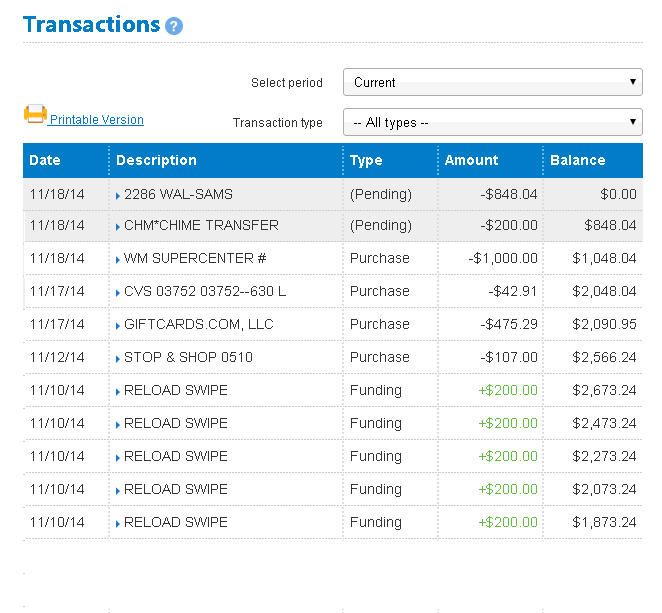

Cellular homebuyers who’re wondering getting financing for a cellular house can begin from the examining the funds. Capable start with looking at the credit rating, given that that apply to what kinds of financing they be eligible for and can become a direct influencer towards interest rates it pays. Overall, the higher someone’s credit score, the reduced the eye costs they can be eligible for. Consumers might also want to observe how much they could relatively put with the a down-payment. Another significant foundation is looking on financial obligation-to-earnings ratio (DTI), and this measures up the degree of newest financial obligation the brand new borrower have facing the typical month-to-month money. The borrower is always to evaluate whether they usually takes to your financing repayments based on how far currency he or she is adding and you will the degree of loans he is already repaying, and also in cases where new borrower have a top DTI, they may notice it harder or even impossible to rating that loan. Individuals can use an internet are formulated home loan calculator to acquire away how loan will set you back and you can variables for the appeal cost tend to fit within their newest funds.

In case the borrower finds that they’re maybe not within the a beneficial lay financially to take on financing, they could manage repairing people products before you apply getting a great mortgage. Options range from debt consolidation reduction, modifying life-style to fit spending plans, or finding an easy way to draw in extra money.