describe

- - Look at your financial qualifications

- - Be aware of the form of mortgage brokers you could potentially avail

- - Get home loan pre-approved

- - Assess

- the mortgage number offered

- the price of financing

- new EMI payable

- the mortgage period

- - KYC, Earnings and you will Modern Possessions data files must be submitted for loan disbursal

Managing property is just one of the greatest monetary ily will previously make. For most earliest-big date home buyers, choosing home financing ‘s the only way they can bring alive the hopes and dreams away from owning a home.

If you’re planning when deciding to take a mortgage, it is vital to see about they; anyway, it’s a partnership that can stumble on age right until you could potentially pay off the whole amount borrowed. Here are 10 items you should become aware of before applying having a home loan:

Qualifications Standards

The initial step take would be to make certain that that you be eligible for a housing mortgage. At the start, lenders will determine your eligibility getting financial towards the basis of income and you will installment capabilities. Others essential factors is ages, certification, financial position, number of dependants, partner’s income and you may work balance.

Brand of Home loans

Contained in this sort of financing, the speed is related into lender’s benchmark rate. If there is a general change in the new benchmark rates, the speed and additionally alter proportionately.

https://paydayloanalabama.com/lisman/

Within the a predetermined speed loan, the pace is restricted in the course of using the financing. So it interest is applicable regarding the tenure of financing.

This type of finance offer part of the borrowed funds on a predetermined rate of interest and you will area within a variable otherwise floating speed of interest.

Home Basic Otherwise Loan Very first

It’s always best to get your home loan pre-recognized one which just pick your property. Pre-recognition makes it possible to boost the real finances and you can can make your residence lookup concentrated. Pre-approvals even help negotiate top and you may romantic marketing less. You can seek advice from the lending company regarding the supply of good qualities on the well-known location. In reality, there are lots of programs that will be approved by the financial, which not simply relaxes how many property data needed by the lending company, but also assurances you of the top-notch the newest ideas.

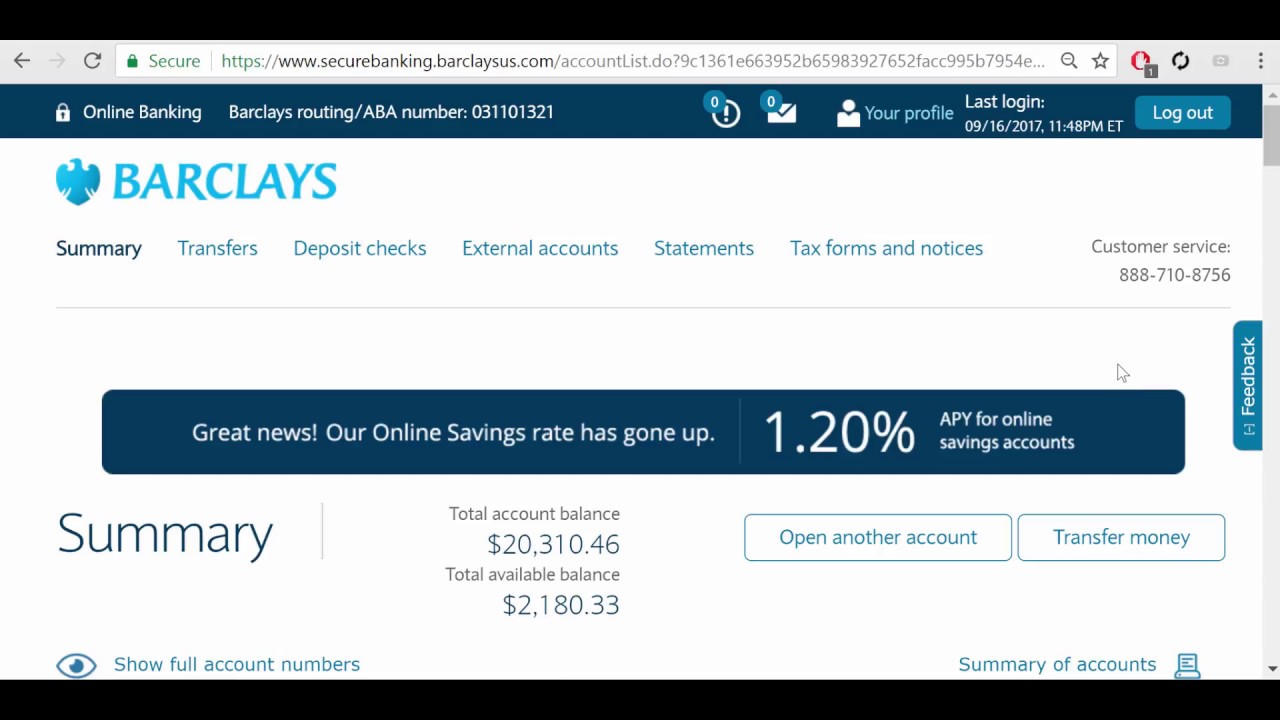

Amount borrowed

Since laid out by the regulator, very lenders bring a construction financing ranging from 75 so you’re able to 90 percent of cost of the property based the loan value. Ergo, in the event your home is respected from the Rs fifty lakh of the bank, you might get a max mortgage regarding Rs forty lakh (80% of the house prices to own loan amount as much as Rs. 75 lakh), based your home financing eligibility. If you were an excellent co-applicant, his/her earnings can be regarded as by bank to improve the newest loan amount. The co-applicant tends to be the adult man, parent otherwise partner. The bill percentage for the purchase of the property is anticipated to help you be provided by you. Such as, whether your home is appreciated at the Rs 50 lakh and you was basically approved a home loan out of Rs 35 lakh, the sum may be the equilibrium Rs fifteen lakh. You are able to a homes mortgage qualifications calculator to evaluate your eligibility to have financial.

Cost of Your residence Loan

The price of their houses mortgage is additionally one thing to to consider when you are determining the viability. The cost includes the eye payments, handling charge, management charges, prepayment punishment, etc. Essentially your property loan have to have no prepayment costs for changeable/floating rates money. It’s also wise to have the ability to transfer the loan to help you a beneficial all the way down rates by spending an affordable percentage. When considering home financing, make sure there aren’t any hidden fees. As per the regulator, loan providers must transparently divulge information regarding costs and fees for the their site.