Pay day loan are easy to find, nonetheless may not be a knowledgeable way to obtain financial support once the of its high will cost you. Choices these types of funds also have far-called for rest from brand new nearly 400% Apr cash advance may charge. In addition to, other sorts of funds possess prolonged cost episodes, letting you create apparently small monthly payments because you clean out personal debt.

Pay-day Option Finance

Pay check Choice Loans (PALs), given entirely owing to borrowing unions, has actually particular statutes that reduce costs you pay and count your use. Such as, app charges are simply for $20 otherwise shorter. You can obtain anywhere between $2 hundred and $step one,one hundred thousand, and you have doing six months to settle the loan.

Personal loans

Playing with a consumer loan normally makes you obtain for symptoms out of a couple so you’re able to 5 years, and regularly of up to seven ages. You to long run contributes to faster monthly payments, so high financing balances are easier to manage. Although not, you have to pay attract so long as your acquire, therefore it is maybe not better so you’re able to stretch some thing aside for too much time. Multiple online lenders are able to work with individuals that have reasonable credit or poor credit.

Playing cards

Playing cards allow you to quickly spend cash or borrow secured on your credit limit having an advance loan. For individuals who curently have a card unlock, which makes one thing effortless. It’s also possible to sign up for another credit card and also an easy address for the recognition. Even though costs can be relatively high, handmade cards are probably cheaper than an online payday loan, and delight in more freedom with regards to payment.

When you have less than perfect credit score, the best possibility within credit cards may be secure borrowing from the bank cards. These cards need a money put you to will act as the borrowing from the bank maximum and you can minimum deposits constantly initiate during the $2 hundred.

Combine Established Debts

In place of trying out much more financial obligation having a pay day loan, you can even make the most of rearranging or refinancing your current loans. When you get a lower speed or extended cost title, you will have straight down monthly obligations, probably reducing the need to use significantly more. Mention debt consolidating money that allow you to plan everything into the you to financing and also have your money disperse under control.

Borrow Having an excellent Co-Signer

A co-signer may help you get approved to possess a personal loan, mastercard, otherwise debt consolidation loan. They submit an application for a loan with you and, thus, the financial institution takes the new co-signer’s credit score into consideration whenever choosing to leave you a good mortgage. To the way to really works, their co-signer must have a premier credit score and plenty of money to pay for monthly premiums (even when you are one expenses, ideally).

Co-signing is generally high-risk, this could be hard to find some one happy to place their credit on the line to you.

Use Of Family unit members otherwise Family relations

Borrowing from the bank out of some one you are sure that is also complicate relationship however, both, simple fact is that best bet to own avoiding large-prices fund. If a person is ready to help you, consider the benefits and drawbacks, and you will consider how some thing goes if you cannot pay the loan. The newest Internal revenue service necessitates that your folks and you member do a beneficial finalized file filled with the latest loan’s fees period and you may the absolute minimum rate of interest. Whenever you can, developed a free appointment that have an excellent CPA and ask them precisely what the tax ramifications of your own financing you are going to look like to have both you and anyone lending for your requirements.

Score a great Payroll Improve

If your work schedule is actually consistent, you are able to ask your employer to incorporate an advance on the coming income. Doing so manage enable you to dodge hefty payday loans will set 2400 dollar loans in Myrtlewood AL you back, but there is a capture: You will get smaller paychecks (otherwise financial places) from inside the further spend symptoms, that will make you inside the an emotional disease.

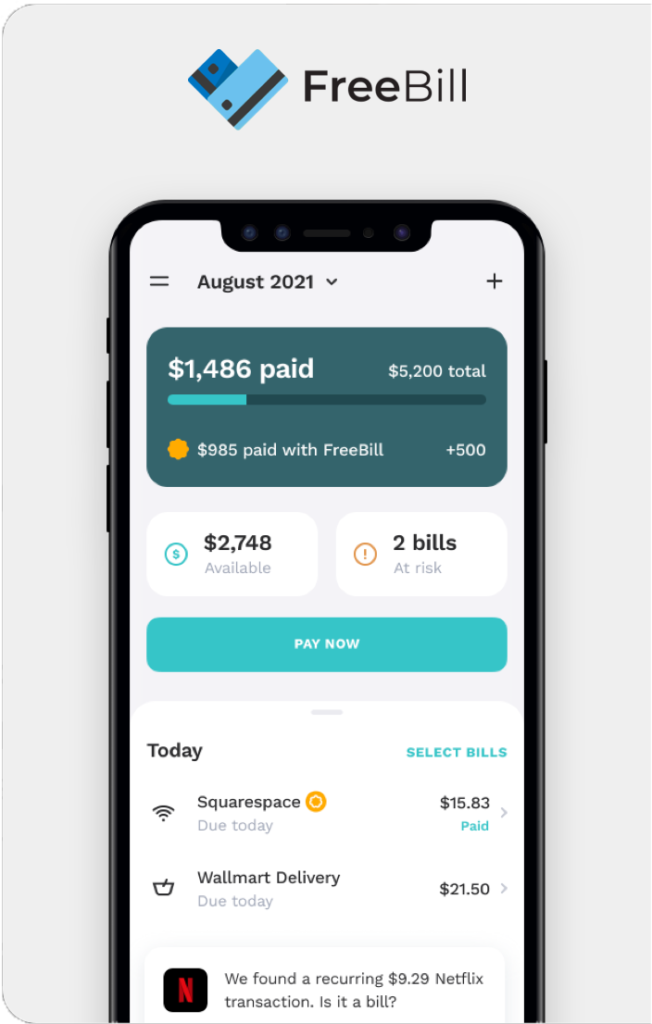

Perhaps one of the most versatile payroll get better programs are Earnin, hence does not fees month-to-month charges otherwise wanted your employer to engage. With Earnin, you could use around $100 to $five hundred just about every day while you are qualified, and services will gather out of your bank account once pay day. There isn’t any notice cost or running commission that have Earnin, you could get off a rule from the software.

If you are considering a payday loan as you need help keeping up with costs otherwise debts, enquire about percentage and you may recommendations programs. Such, the car-financing bank could be willing to really works one thing out to you. You might be capable discuss for put-off payments otherwise a some other percentage schedule, which could get rid of the have to take towards even more obligations or get car repossessed.

Envision Regulators Programs

Local assistance programs through your Agencies out of Health insurance and Individual Characteristics also may help your defense certain expenses. Your neighborhood work environment need to have information on many different financial help software that may defense the price of as well as almost every other expenses.

Instance, brand new Supplemental Nutrition Guidelines System (SNAP) you may promote as much as $835 30 days purchasing dinner. If you find yourself eligible for the program, the money you have made having food may help you end delivering away a loan.

Crisis Discounts

When you find yourself lucky enough for emergency savings available, believe tapping that cash in place of bringing a quick payday loan. One to aim of an emergency money should be to make it easier to meet your position while avoiding high priced loans-and you’ll be in the center of an emergency. Of course, it’s best to maintain your coupons undamaged when you find yourself considering borrowing to own a good want instead of good “you would like.”

Other Financial Movements

Should your procedures over never release earnings, you could find some save having conventional (however necessarily simple) money actions. Offering things very own can help you raise bucks quickly, but only if you have rewarding factors you may be ready to part having. Making extra because of the performing a great deal more tends to be an alternative choice, and needs you have the full time, energy, and you may possibility to do it. Fundamentally, reducing can cost you may help to some extent, for folks who haven’t currently trimmed your investing.