When you are to shop for a property, the fresh new documents process are going to be confusing, overwhelming, and you will relatively versus prevent. For many people, getting your own house remains the newest American dream, but it’s even more challenging and hard to obtain recognition on a mortgage loan off a financial. That it guides of several possible people to expend a lot of money, date, and you may heart towards the obtaining household they need, just to feel the financing break down at the last second.

Private loan providers, such as Financial Concepts Financial, render some gurus along the old-fashioned financial home loan framework. Knowing the change is important if you are searching to invest in a property.

What exactly is a personal Home loan Lender?

Providing home financing as a result of a financial can be good solution if you have unblemished borrowing, effortless access to in depth monetary info, and several perseverance. Cost are down should you get home financing thanks to a great lender against. an exclusive financial, not, most people never manage to get thier mortgage accepted via the antique lender home loan route. He’s really rigorous certification and you will assistance that have to be found since loans is federally insured. If you’ve got a bad credit score or people imperfections on your own credit history, you could find the loan software refuted – immediately following a very long, stressful wait.

Personal lenders, additionally, services playing with loans supplied by private dealers. These types of individual dealers may include finance companies, people, otherwise one another. Personal lenders particularly render private funds. As these loans can hold an advanced level off chance, the eye costs are also a tiny more than everything perform score with home financing out of a classic bank. The fresh dealers whom funds the non-public loan company make their money from the rates won into the private finance they extend. Mainly because costs are usually higher, they are able to usually earn over average costs out-of return to their funding.

As to why Prefer a personal Bank In place of a financial?

For just one, a private home mortgage lender including Monetary Rules Home loan even offers deeper liberty than extremely old-fashioned financial institutions. When you find yourself private loan providers still need to conform to many of the same usury laws one a classic bank do, personal credit establishments is less purely managed than financial institutions. This enables these to structure various sorts of fund you to have a tendency to match the buyer’s direct finances to their home ownership desires.

Acquiring a mortgage loan due to an exclusive bank is normally a good a lot faster and simpler process than getting one off a bank. Finance companies need comply with numerous possible agencies for example Federal national mortgage association, Freddie Mac computer, U.S. Department of Houses and you will Metropolitan Creativity (HUD), or perhaps the Veterans Government (VA), which have most rigorous guidelines toward who’s an acceptable candidate for a loan. There are slopes of paperwork, those variations so you’re able to indication, and some documents to help you compile and you can fill in, often more weeks, within the typical financial mortgage software procedure. When you get a home loan away from a bank, it punch in several investigation right after which a pc determines in the event you are a fair borrowing risk. There’s little to no discretion to maneuver from people criteria and needs.

Individual loan providers take an even more personalized and you may tailored method to financing. Like, an exclusive financial might possibly overlook defects from your own past that seem in your credit history and you can envision activities much much more newest, such as your personal debt-to-income proportion. It assess the loan you are searching for providing and you may thought when it’s practical for the income. Should your chance appears a bit higher, they can often nonetheless offer you that loan you to definitely a traditional bank would not, within a slightly large rate of interest to really make the private lender’s people become comfortable with the institution delivering one risk.

How does Private Financing Works?

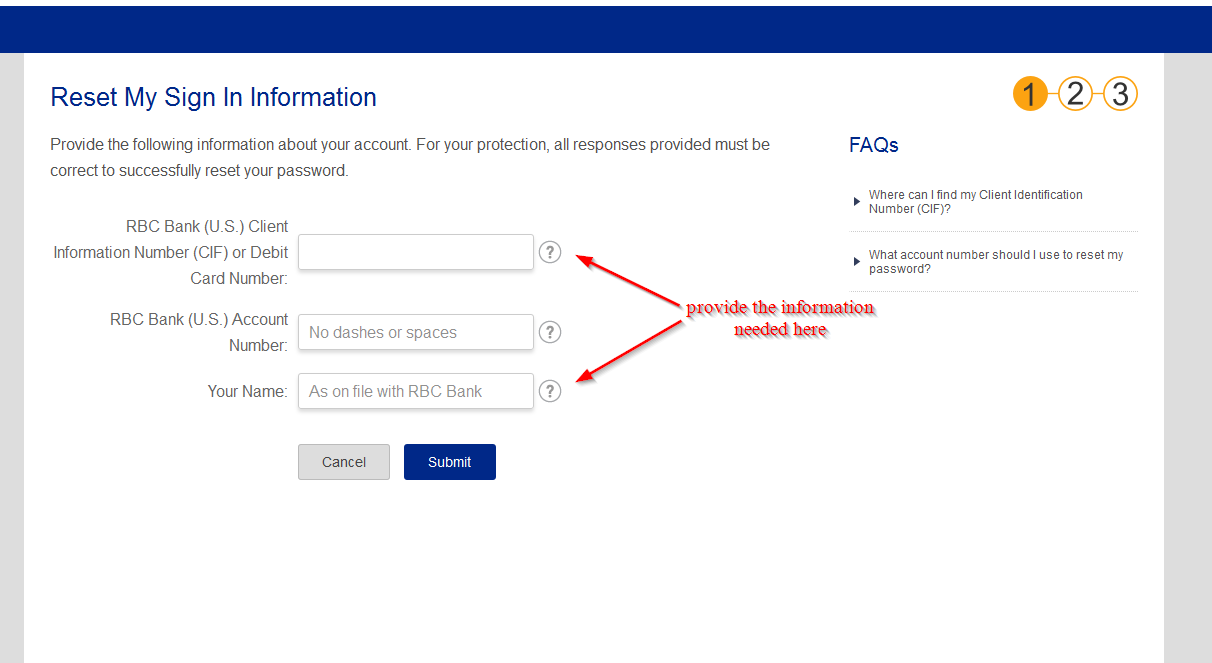

Comparable to that have a timeless lender mortgage, step one are obtaining prequalification. We offer a https://clickcashadvance.com/loans/short-term/ good record off data you will have to rating been with your software. The preapproval will help you to know how to framework your quest to their qualifying budget.

If you have already known a property you want to get and will be ready to generate an offer, contact your personal lender so that they can bring an evidence of finance emails for your requirements. We know things is also move easily to the bidding procedure, therefore we try to rating what you want the same day you put in a consult, even in just several hours, whenever possible. If you have already had a quote acknowledged, i work with you to rapidly get the assessment and you will check done this you can keep the procedure moving easily. The speed grounds will be a big benefit to people that invest in home to own monetary sales, such as those which get likely to augment within the house and you may quickly lso are-offer or flip they.

In essence, long lasting function of your own mortgage application, the process really works much as it would with a loan off a lender, except it is faster and simpler.