not, you may have most other, inexpensive possibilities, as a consequence of credit card financing software that permit you borrow secured on the card’s current borrowing limit – which is generally what you do once you demand a traditional payday loan

- You do not get profit hand quickly. With my Chase Financing, the fresh lent money usually takes one to two working days in order to be direct-placed into the membership. Citi Bend Finance may have been in the form of a direct put, that takes only a business time, or a mailed have a look at, that takes yet not much time the fresh mail takes.

- Interest rates may possibly not be as effective as personal loans. Depending on that which you qualify for, you are qualified to receive down costs into the other kinds of funds (no matter if getting a personal bank loan, you will do must apply and you may undergo a credit assessment). For those who have a little more time and energy to shop around, it can be really worth seeing exactly how more you can buy new money you want.

- You’ll be able to nevertheless spend interest. If you like money to possess upcoming orders, there are more you’ll fee alternatives charging you zero focus, you tends to be at the mercy of a charge.

Alternatives to adopt

If you have pricey purchases planned, it is possible to play with handmade cards so you’re able to decelerate attract costs otherwise split up repayments:

Although not, you may have most other, less costly possibilities, through credit card financing software that allow your borrow secured on the card’s existing borrowing limit – that’s basically everything you manage after you consult a traditional cash advance

- A buy now, pay later-such plan during your charge card – such as for instance My personal Chase Package or Citi Fold Shell out – allows you to separated a bigger costs into monthly premiums you to are added onto your own charge card statement. Having Chase, you are able to pay a fixed fee every month, whenever you are which have Citi’s bundle, you are recharged notice. A great many other major issuers render some brand of these types of agreements. However, if you decide toward a payment package through your borrowing credit otherwise through a 3rd-class buy now, pay afterwards provider, get it done alerting. A report regarding the Consumer Monetary Shelter Bureau means pricey threats of this these types of agreements, like the odds of paying much more the risk of becoming unable to manage money for people who pile numerous financing at the same time.

- A credit card having a good 0% interest strategy on the the fresh sales can provide a year or so much more, with respect to the card, to expend off an equilibrium focus-100 % free. Only remember that for those who have any leftover obligations if the strategy comes to an end, you’ll be able to beginning to feel energized the fresh card’s typical interest.

not, you have got most other, economical alternatives, using credit card mortgage apps that let your borrow on your card’s existing borrowing limit – which is generally everything manage after you consult a classic cash advance

- Text messages

Younger Thai work environment Far-eastern people using mobile device texting massage therapy with their pal after finishing up work generate appointment to hang away at night facing main company area at the bangkok thailand

Although not, you may have other, cheaper selection, by way of bank card mortgage software that allow your borrow on the card’s current borrowing limit – that’s essentially everything create once you https://clickcashadvance.com/installment-loans-va/windsor/ demand a traditional pay day loan

- Text messages

- Print Duplicate article link

Once you do not have the money in to your bank account to work that have surprise costs, credit cards payday loans is one way locate small accessibility needed finance – but you can find biggest drawbacks. You’ll be to your connect for the money progress and you will Automatic teller machine costs, and desire that actually starts to accrue once you have made the bucks.

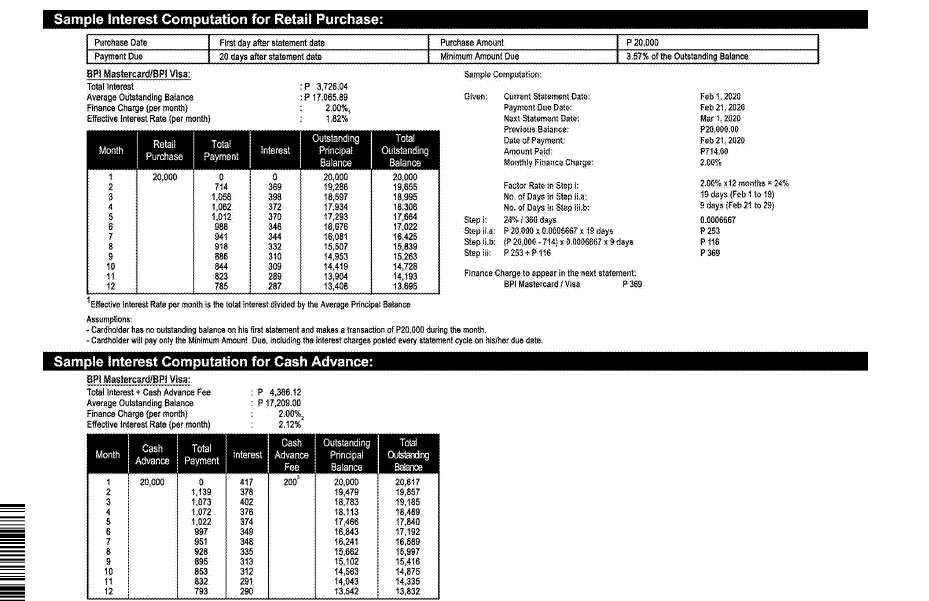

And you can about that focus: According to study in the Federal Reserve out-of St. Louis, average ong notes that recharged attract reached 20.4% in the .

However, you’ve got other, economical alternatives, compliment of mastercard financing applications that allow you borrow on your card’s established borrowing limit – that’s essentially what you perform once you demand a vintage cash advance

- A fixed rate of interest toward life of the loan.