In this section, we will explore the different fields where transposition errors frequently occur and discuss effective strategies to identify and resolve them. Navigating the world of transposition errors requires a multifaceted approach. It is crucial to prioritize accuracy and reliability in all aspects of our lives, ensuring that transposition errors do not hinder our progress or compromise the integrity of our data. Another effective strategy to mitigate the impact of transposition errors is the use of double-entry verification. This method involves independently entering the same information twice and comparing the two entries for consistency.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

- Only through proactive measures can we unravel the mystery of transposition errors and safeguard against their potential repercussions.

- Transposition errors are a common occurrence in various fields, ranging from finance to data entry.

- By comparing the two entries, any transposition errors can be easily identified and corrected.

Transposition Error: Definition, Causes, and Consequences

Many OCR software applications include error detection features that identify potential transposition errors, such as swapped digits. By using OCR software, you can efficiently detect and correct transposition errors in large volumes of digitized documents. For example, a business may be transposition error saddled with an increased tax liability if the transposition error is large enough to slingshot that company into a higher tax bracket.

Consequences of Uncorrected Transposition Errors

The most common cause is human error, which can be attributed to the inherent limitations of manual data entry. When typing or transcribing information, individuals may unintentionally swap adjacent characters or digits, especially when dealing with long sequences of numbers or repetitive patterns. Additionally, fatigue, normal balance distraction, or lack of attention to detail can amplify the likelihood of these errors. One of the most effective ways to correct transposition errors is through manual verification and double-checking. By taking the time to thoroughly examine the information, it is possible to catch and rectify errors before they cause any harm. For example, when entering financial data into a spreadsheet, cross-referencing the figures with the original documents can help identify and correct any transposition errors.

Errors of Omission FAQs

Transposition errors may also occur when checks are filled out incorrectly, resulting in improper payment amounts that can cause overdrafts and other banking issues. Furthermore, transportation errors can result in incorrectly-recorded phone numbers, street addresses, or ZIP codes in customer profiles. And although the aforementioned mistakes are typically easily remedied, in some cases, transposition errors relating to medicinal dosing information may lead to tragic consequences. Transposition errors can have a significant impact on the accuracy and reliability of data. Whether it’s a simple switch of two digits or the rearrangement of an entire sequence, these errors can lead to misunderstandings, financial losses, and even legal complications. From a business perspective, transposition errors can result in incorrect invoices, delayed shipments, and inaccurate financial statements, damaging the reputation and credibility of an organization.

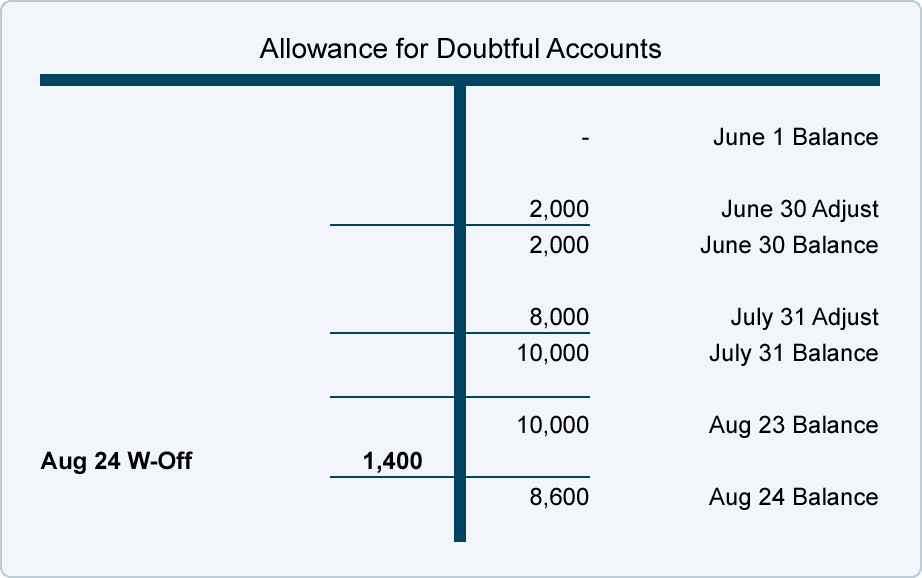

By doing so, we introduce redundancy into the system, which acts as a safety net against transposition errors. For instance, in financial accounting, the double-entry bookkeeping system requires each transaction to be recorded twice, once as https://www.bookstime.com/ a debit and once as a credit. By comparing the two entries, any transposition errors can be easily identified and corrected. This method not only enhances accuracy but also provides a robust means of error detection, minimizing the potential financial implications of transposition errors. One of the most effective ways to combat transposition errors is by implementing error-checking mechanisms. By incorporating these mechanisms into our systems and processes, we can identify and rectify errors before they cause significant damage.