Secret takeaways

- The prime price support financial institutions regulate how much appeal so you’re able to charges its customers.

- All of the six weeks, the Government Set aside assesses the fresh economy and you may determines whether your rates should go upwards, off, otherwise continue to be the same.

- A general change in the prime speed can affect playing cards, home guarantee personal lines of credit, college loans, and you can coupons accounts.

Unless you are good banker or most looking business economics, it is far from likely that a discussion regarding primary rates often arise at your dinner table or perhaps in texts as well as forth together with your bestie. However,, its a common title you to influences nearly all us within the a way, as it enjoys an effect on how much cash i pay during the attention into the currency i obtain therefore the get back we have toward profit our discounts accounts.

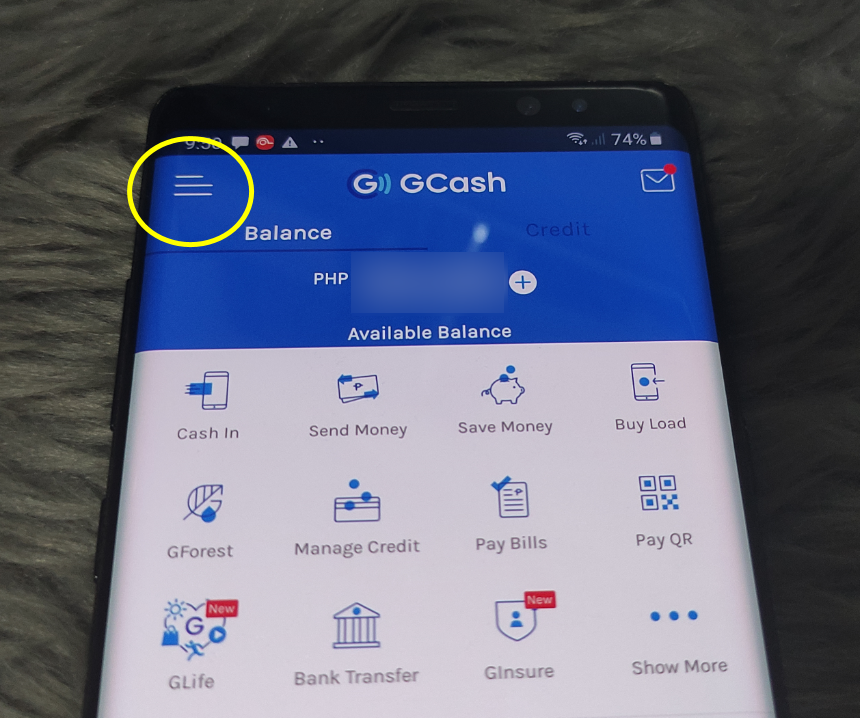

Very, what’s the perfect speed?

From inside the Government Reserve, Brand new Government Open market Panel (FOMC) matches all six weeks to go over and set brand new government finance rate; sometimes it change and regularly it does not. They look at the cost savings or any other monetary symptoms to determine whatever they believe could well be an effective price to own banking institutions to help you lend both currency. During the reduced economies, the fresh new FOMC attempts to contain the federal money speed reasonable to encourage borrowing, which results in purchasing and you will expenses, nevertheless when the newest savings expands easily, this new FOMC might raise the speed in order to counterbalance and equilibrium the latest cost savings.

The prime price, subsequently, will be based upon the federal fund rates. Called The newest Wall Street Record primary price or even the You.S. Perfect Rates, it is a standard place and you may employed by financial institutions to determine just how much attract to help you charges an effective bank’s consumers to your funds. Continue reading