- Those things drawn in the fresh new wake of the Higher Recession allayed the commercial burdens of one’s overall economy, although housing market nevertheless stays vulnerable to systemic problems that haven’t been effortlessly treated.

- When you find yourself usage of borrowing from the bank try justifiably tightened after the overall economy, evidence shows that the newest limits and requirements tends to be continuously hindering homeownership growth.

- While the 2008, the brand new supplementary home loan industry have seen a significant withdrawal away from personal financial support and you may an increased wedding out-of Fannie mae and Freddie Mac. Numerous proposals has outlined simple overhauls to restore the presence of individual financing, however, policymakers have to reform the business to help you foster race and you will liability without sacrificing stability and you will exchangeability.

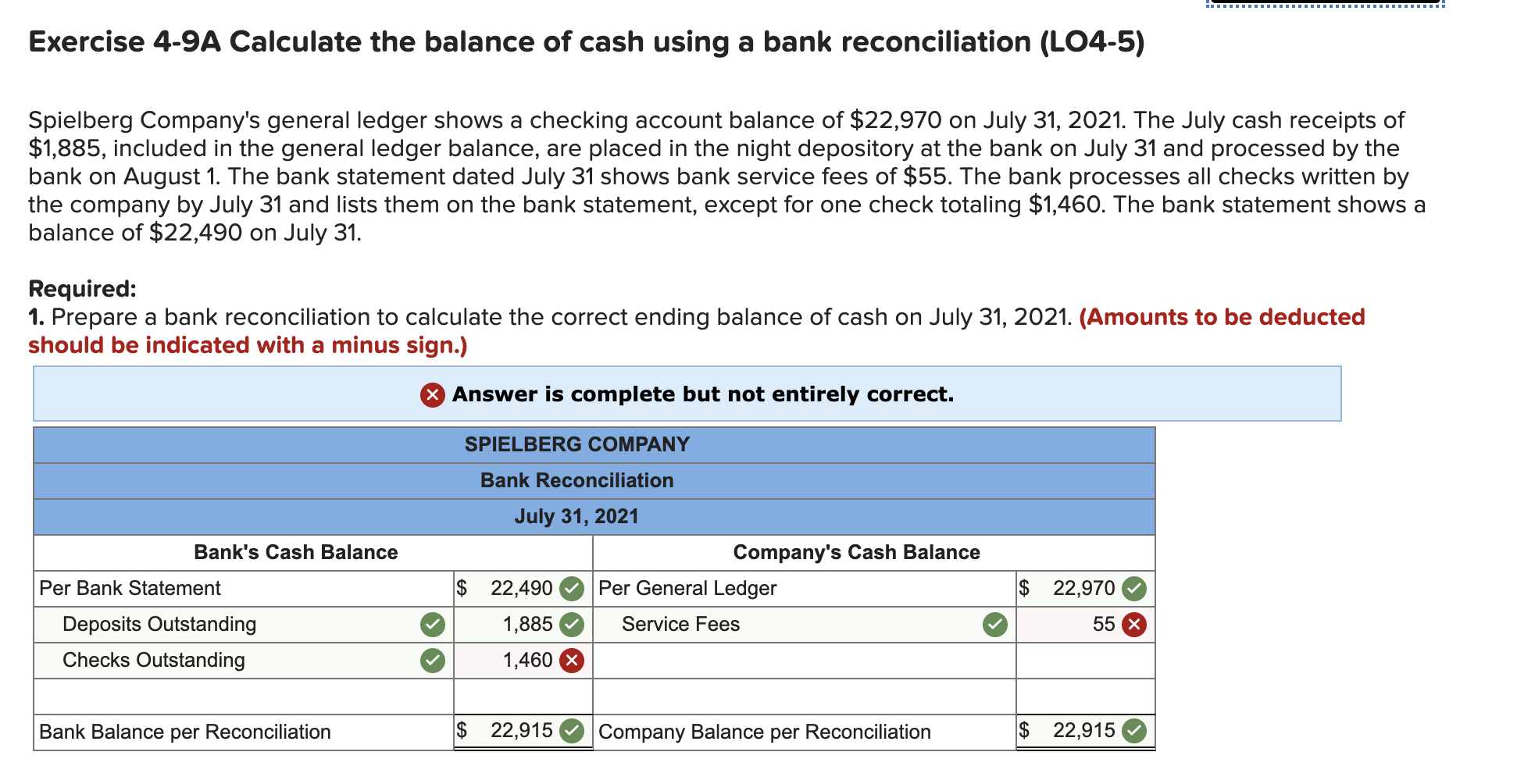

The key market is where financial originators, instance banking institutions, directly loans individuals having fund

The loan financing system will be separated on a couple of entities that really work to each other: an important mortgage industry plus the second home loan field. The secondary field, meanwhile, contains establishments that provides financial originators which have liquidity mainly of the buying its mortgages and you will pooling all of them just like the mortgage-supported bonds. These types of associations offer these securities, which happen to be covered against default, to help you dealers, exactly who next very own new claim to the principal and interest money on the packed mortgages. Continue reading