Six Procedures in order to a WHEDA Mortgage

Buying a property is one of the greatest, most exciting behavior you are able to actually make. Assist WHEDA show you on your next home.

Step one: Control your Money

Have your earnings under control before applying for a financial loan. Creating a spending plan you to lies out your income and you may expenditures try in addition to a great way to discover ways to manage your currency.

See your credit score

After you’ve made a decision to purchase property, it is a good idea to comment your own credit. The type of financing you have made, including rate of interest, is especially dependent on your credit rating, called a beneficial FICO score. Its a good idea to get a copy of credit report and learn how to see and you can know it. The majority of WHEDA’s applications wanted the absolute minimum credit history out of 620.

Do a spending plan and you may manage your money

- Start with determining your expenses

- Continue a detailed checklist of the many earnings and expenses

- So it record ought to include all your valuable costs

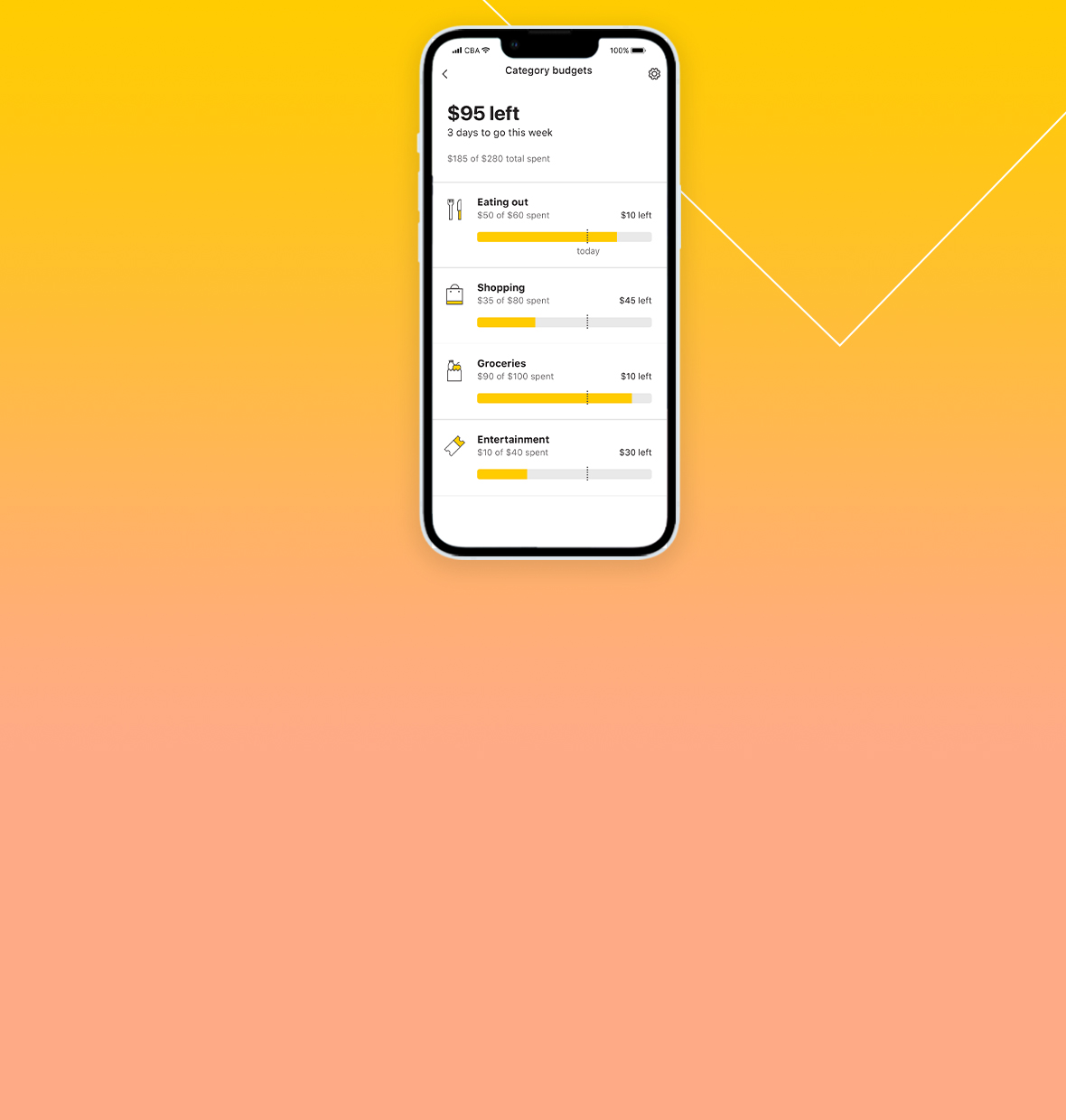

You can also use Propel, a finance management tool based in Send Bank’s cellular app so you’re able to tune your income and you will expenditures.

Step 2: Pick a lender

Searching for a lending company is about over shopping for one which gives the most useful rates; we would like to focus on a loan provider which provides systems and you will will assist guide you from the procedure.

WHEDA now offers a great statewide system away from lending people along with Submit Bank. All of our mortgage lender people will appear at the monthly earnings, credit score, and obligations height in order to be considered your having a WHEDA mortgage that best fits your needs.

3: Available Home loan Apps

- WHEDA Advantage Old-fashioned

- WHEDA Easy Romantic DPA

- WHEDA Financial support Supply DPA

Rating educated! First-day borrowers playing with an effective WHEDA loan are required to just take an excellent domestic buyer training class. Continue reading