Brian enjoys almost two decades of expertise exercises during the classrooms and working as an exclusive tutor for levels 7 courtesy a dozen. He’s got an excellent Bachelor’s Training at this moment which have an emphasis on the 20th century You.S. Background.

- What is Redlining?

- Redlining Background plus the High Despair

- Redlining Meaning Today

- Segregation vs. Private Financial Points

What is redlining basically?

The thing that makes redlining unethical?

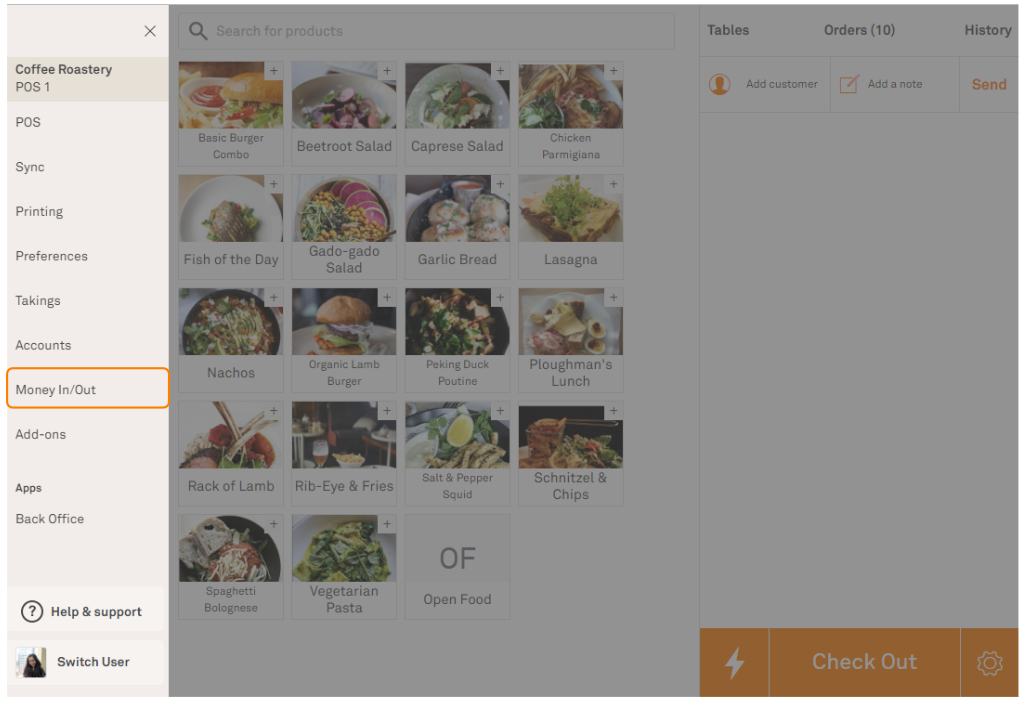

Redlining function doubting economic qualities so you’re able to one centered solely towards the their competition or ethnicity. Its shady to make use of race or ethnicity as the a grounds to have qualifying to possess borrowing or any other monetary functions.

What’s redlining at this moment?

Over the years, redlining relates to a habit of the FHA and you will HOLC to help you deny lenders to the people residing low-white neighborhoods. Continue reading